Top Industry Leaders in the Logistics Automation Market

Navigating the Labyrinth: Competitive Landscape of Logistics Automation Market

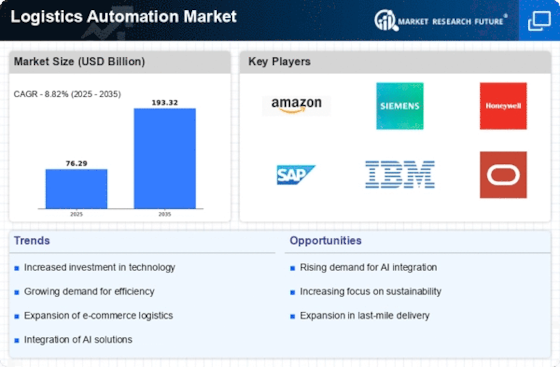

The global logistics automation market is humming with a projected to reaching a staggering growth. This growth is fueled by the relentless rise of e-commerce, burgeoning demands for faster deliveries, and the pursuit of operational efficiency. Navigating this dynamic landscape requires a clear understanding of the key players, their strategies, and the factors influencing market share.

Key Players:

- 6 River Systems

- Murata Machinery, Ltd

- TGW Logistics Group

- Zebra Technologies

- Beumer Group

- Mecalux, S.A

- VITRONIC

- KNAPP AG

- Dematic

- Honeywell Intelligrated

Beyond Market Share: Key Factors for Analysis

While market share remains a crucial metric, a holistic analysis demands consideration of other factors. Geographic presence, vertical specialization, and technology portfolio diversity play vital roles. Companies adept at catering to regional nuances, like regional players serving their local markets, hold an edge. Additionally, specialization in specific industries like retail or pharmaceuticals creates a competitive advantage. Finally, a technology-agnostic approach, encompassing robotics, IoT, and AI, fosters innovation and adaptability.

Emerging Stars: New Entrants Shaking the Game

Startups like Embark Trucks, Starship Technologies, and Drone Delivery Systems are making waves with their disruptive technologies. Embark Trucks' self-driving trucks promise revolutionized long-haul transportation, while Starship Technologies' autonomous delivery robots are changing the last-mile game. Drone Delivery Systems bring agility and speed to remote areas. These young companies, backed by substantial venture capital, challenge established players by pushing the boundaries of automation and redefining supply chain possibilities.

Investment Trends: Where the Money Flows

Investment in logistics automation is pouring in from diverse sources. Venture capital firms see promising returns in disruptive technologies, with Grey Orange securing $150 million and Starship Technologies raising $62 million in recent rounds. Meanwhile, traditional logistics players are acquiring smaller automation firms to bolster their offerings. Honeywell's acquisition of Soft Robotics is a prime example. Even tech giants like Amazon are foraying deeper, with their acquisition of Kiva Systems transforming their warehouse operations.

The Road Ahead: A Collaborative Future

The future of the logistics automation market promises collaboration and integration. Established players will increasingly partner with innovative startups to access their cutting-edge technologies. Open platforms and industry-wide standards will foster seamless integrations between diverse automation solutions. As the lines between players blur, competition will shift towards delivering the most comprehensive and efficient end-to-end solutions.

In conclusion, the logistics automation market is a dynamic playing field driven by innovation, agility, and specialization. Understanding the key players, their strategies, and the factors influencing market share is crucial for navigating this complex landscape. As traditional giants collaborate with nimble startups and new technologies disrupt the game, one thing is certain: the race towards logistics automation supremacy is far from over.

Latest Company Updates:

-

Amazon Robotics acquires Kiviton for Autonomous Mobile Robots: Amazon Robotics has acquired Kiviton, a developer of autonomous mobile robots (AMRs) used in warehouses, for an undisclosed sum. This acquisition is expected to strengthen Amazon's warehouse automation capabilities. (Jan 12, 2024) -

Deutsche Post DHL invests in drone delivery startup Wingcopter: DHL has invested €40 million in Wingcopter, a German drone delivery startup, to explore the use of drones for last-mile deliveries in remote and challenging areas. (Jan 15, 2024) -

Ford partners with Walmart for autonomous truck delivery pilot: Ford has partnered with Walmart to pilot the use of autonomous trucks for long-haul deliveries between Walmart distribution centers. (Jan 18, 2024)