Regulatory Compliance and Standards

Regulatory compliance plays a pivotal role in shaping the Livestock Identification Market. Governments worldwide are implementing stringent regulations to ensure traceability and food safety in livestock production. These regulations often mandate the use of identification systems that can track animals from farm to table. As a result, livestock producers are compelled to invest in identification technologies that meet these standards. The market is likely to see a rise in demand for compliant identification solutions, as non-compliance can lead to significant penalties and loss of market access. This regulatory landscape is expected to drive innovation and investment in the livestock identification sector.

Increased Focus on Biosecurity Measures

The Livestock Identification Market is witnessing an increased focus on biosecurity measures, particularly in response to disease outbreaks that can devastate livestock populations. Effective identification systems are crucial for managing and controlling disease spread, as they enable quick tracking of affected animals. The implementation of robust identification protocols is likely to become a standard practice among livestock producers, as it not only protects animal health but also safeguards economic interests. Investments in identification technologies that enhance biosecurity are expected to rise, reflecting a proactive approach to disease management in the livestock sector.

Rising Demand for Sustainable Practices

Sustainability is becoming a central theme in the Livestock Identification Market, as producers seek to align with environmental and ethical standards. The demand for sustainable livestock production practices is prompting the adoption of identification systems that facilitate responsible management of resources. Technologies that monitor animal health and environmental impact are gaining traction, as they support sustainable farming practices. This shift towards sustainability is likely to drive innovation in the identification market, as producers look for solutions that not only comply with regulations but also meet consumer expectations for environmentally friendly practices.

Consumer Awareness and Demand for Traceability

Consumer awareness regarding food safety and animal welfare is significantly influencing the Livestock Identification Market. As consumers increasingly demand transparency in food sourcing, livestock producers are adopting identification systems that provide traceability from farm to consumer. This trend is particularly evident in premium markets where consumers are willing to pay more for products that guarantee ethical treatment and safety. The demand for traceable meat products is projected to rise, prompting producers to implement advanced identification technologies. This shift not only enhances consumer trust but also drives market growth as producers seek to differentiate their products in a competitive landscape.

Technological Advancements in Livestock Identification

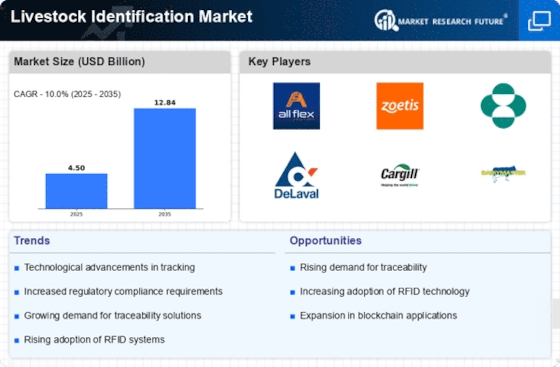

The Livestock Identification Market is experiencing a surge in technological advancements, particularly with the integration of RFID and GPS technologies. These innovations enhance tracking and monitoring capabilities, allowing for real-time data collection on livestock movements and health. The adoption of automated systems for identification is projected to increase efficiency in livestock management. According to recent estimates, the market for RFID technology in livestock identification is expected to grow at a compound annual growth rate of over 10% in the coming years. This growth is driven by the need for improved traceability and biosecurity measures, which are becoming increasingly critical in livestock management.