Liver Health Supplements Size

Liver Health Supplements Market Growth Projections and Opportunities

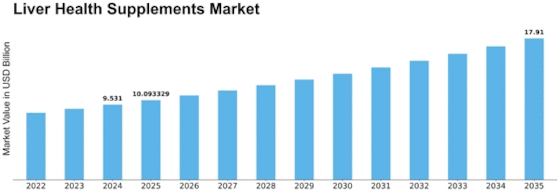

The Liver Health Supplements Market will have a size of 14.23 billion USD by 2032 at a CAGR of 5.9% during the forecast period. The liver health supplements market is affected by several factors altogether shaping its dynamism and growth path. One of the chief drivers for this market is the increasing global prevalence of liver disorders. Also, the elderly world population has influenced greatly the Liver Health Supplements Market. With advancing age, the livers lose their ability to regenerate and function efficiently on their own; therefore, older people are more prone to illnesses leading them into seeking alternative therapies by taking these supplements. A substantial consumer base for products that promote healthy livers has emerged as a result of this demographic shift. The preventive care sector’s emphasis on proactive healthcare management has further lifted demand for liver health supplements among others. People have changed towards prevention when it comes to maintaining good health and wellness in general where liver health forms a key part of this approach. Thus, consumers are opting for natural remedies with ingredients like milk thistle, turmeric root, antioxidants noted for their protection against toxic substances from reaching or damaging our livers thereby influencing the direction taken by these markets. Apart from changing buyer preferences regulatory issues also influence Liver Health Supplements Market greatly. Governments and other health authorities globally have established strict rules designed to ensure safety and efficiency of dietary supplement industry all over the world. Manufacturers therefore must remain compliant while developing products formulations or marketing strategies because they form one of their considerations. Lastly, no proper understanding can be done without analyzing how digitization affects customers’ behavior within the context at hand i.e. Liver Health Supplements Market. The availability of information on demand and increased number of ecommerce sites has changed the way people seek, evaluate and purchase medical supplements. Manufacturers can reach a wider market segment through these online channels to access different consumers and meet the needs of tech-savvy customers. Further, competitive dynamics in Liver Health Supplements Market are also influenced by product innovation as well as marketing strategies among others like packaging designs and promotions. Manufacturers constantly develop new combinations of ingredients for their products within the existing congested market by using different formulations. Such supplements will be able to win their clients with unique branding and marketing initiatives emphasizing on what makes them different from others.

Leave a Comment