Rising Healthcare Expenditure

The upward trend in healthcare expenditure is a significant driver for the Liver Disease Diagnostic Market. As countries allocate more resources to healthcare, there is a corresponding increase in funding for diagnostic services. This trend is particularly evident in regions where healthcare systems are evolving to meet the needs of aging populations and rising disease prevalence. Increased investment in healthcare infrastructure enables the procurement of advanced diagnostic equipment and technologies, thereby enhancing the quality of liver disease diagnostics. Furthermore, as patients become more willing to invest in their health, the demand for comprehensive diagnostic services is likely to grow. This shift in healthcare spending patterns is expected to positively impact the liver disease diagnostic market, as stakeholders seek to provide effective and timely diagnostic solutions.

Increased Awareness and Education

Growing awareness regarding liver health and disease prevention is a significant driver for the Liver Disease Diagnostic Market. Public health campaigns and educational initiatives have heightened understanding of liver diseases, leading to increased screening and diagnostic testing. As individuals become more informed about risk factors and symptoms, they are more likely to seek medical advice and diagnostic services. This trend is reflected in the rising number of liver function tests and screenings conducted annually. Moreover, healthcare providers are emphasizing the importance of early detection, which is crucial for effective treatment. The heightened focus on liver health is likely to sustain the demand for diagnostic solutions, as proactive health management becomes a priority for many individuals.

Regulatory Support and Guidelines

Regulatory frameworks and guidelines established by health authorities are pivotal in driving the Liver Disease Diagnostic Market. Governments and health organizations are increasingly recognizing the importance of early diagnosis and management of liver diseases. This has led to the implementation of policies that promote the development and adoption of advanced diagnostic technologies. For example, regulatory bodies are providing incentives for research and development in liver diagnostics, which encourages innovation. Additionally, the establishment of standardized diagnostic protocols enhances the reliability of testing methods, fostering trust among healthcare providers and patients alike. As regulatory support continues to strengthen, it is expected that the market for liver disease diagnostics will expand, facilitating access to essential diagnostic tools.

Rising Prevalence of Liver Diseases

The increasing incidence of liver diseases, such as hepatitis and cirrhosis, is a primary driver for the Liver Disease Diagnostic Market. According to recent data, liver diseases affect millions worldwide, with hepatitis B and C infections being particularly prevalent. This rise in cases necessitates advanced diagnostic tools to facilitate early detection and treatment. The World Health Organization estimates that liver diseases account for a significant percentage of global mortality, underscoring the urgent need for effective diagnostic solutions. As awareness of liver health grows, healthcare providers are increasingly investing in innovative diagnostic technologies, thereby propelling the market forward. The demand for accurate and timely diagnostics is likely to continue to rise, as untreated liver conditions can lead to severe complications, further emphasizing the importance of this market.

Technological Innovations in Diagnostics

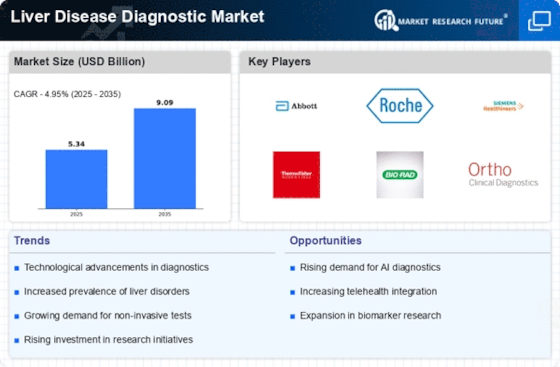

Technological advancements play a crucial role in shaping the Liver Disease Diagnostic Market. Innovations such as non-invasive imaging techniques, advanced biomarkers, and artificial intelligence are transforming the landscape of liver diagnostics. For instance, the development of elastography and MRI techniques has improved the accuracy of liver disease assessments, allowing for better patient management. The market for liver diagnostics is projected to grow significantly, driven by these technological innovations. Furthermore, the integration of digital health solutions, including telemedicine and mobile health applications, enhances accessibility to diagnostic services. As these technologies evolve, they are expected to reduce the burden on healthcare systems while improving patient outcomes, thereby fostering growth in the liver disease diagnostics sector.