Expansion of Electric Vehicle Market

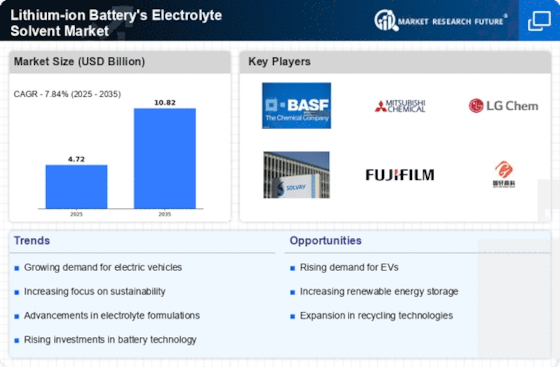

The expansion of the electric vehicle (EV) market is a pivotal driver for the Lithium-ion Battery's Electrolyte Solvent Market. As governments and consumers increasingly prioritize sustainable transportation, the demand for electric vehicles is projected to rise sharply. In 2025, the EV market is expected to witness a compound annual growth rate of over 20%, leading to a corresponding increase in the need for lithium-ion batteries. These batteries rely heavily on high-performance electrolyte solvents to ensure optimal functionality and safety. The growing adoption of EVs not only boosts the demand for lithium-ion batteries but also emphasizes the critical role of electrolyte solvents in enhancing battery life and efficiency. Consequently, this trend is likely to propel the electrolyte solvent market forward, as manufacturers seek to meet the evolving needs of the automotive industry.

Regulatory Support for Sustainable Practices

Regulatory support for sustainable practices is emerging as a significant driver for the Lithium-ion Battery's Electrolyte Solvent Market. Governments worldwide are implementing stringent regulations aimed at reducing carbon emissions and promoting environmentally friendly technologies. This regulatory landscape encourages manufacturers to adopt greener practices, including the use of eco-friendly electrolyte solvents. As a result, there is a growing emphasis on developing solvents that minimize environmental impact while maintaining performance standards. The push for sustainability is likely to reshape the electrolyte solvent market, as companies strive to comply with regulations and meet consumer expectations for greener products. This trend not only enhances the market's appeal but also fosters innovation in solvent formulations, potentially leading to the introduction of new, sustainable alternatives that align with regulatory requirements.

Increasing Demand for Energy Storage Solutions

The Lithium-ion Battery's Electrolyte Solvent Market is experiencing a surge in demand due to the increasing need for efficient energy storage solutions. As renewable energy sources such as solar and wind become more prevalent, the requirement for reliable energy storage systems intensifies. Lithium-ion batteries, known for their high energy density and longevity, are at the forefront of this transition. According to recent data, the energy storage market is projected to grow significantly, with lithium-ion batteries accounting for a substantial share. This trend is likely to drive the demand for electrolyte solvents, which are crucial for the performance and safety of these batteries. The growth in energy storage applications, particularly in residential and commercial sectors, further underscores the importance of electrolyte solvents in enhancing battery efficiency.

Technological Innovations in Battery Manufacturing

Technological innovations in battery manufacturing are significantly influencing the Lithium-ion Battery's Electrolyte Solvent Market. Advances in production techniques and materials are leading to the development of more efficient and safer lithium-ion batteries. Innovations such as solid-state batteries and improved electrolyte formulations are gaining traction, which may enhance battery performance and longevity. As manufacturers adopt these new technologies, the demand for specialized electrolyte solvents that can support these advancements is likely to increase. Furthermore, the integration of automation and artificial intelligence in battery production processes is expected to streamline operations and reduce costs, thereby fostering growth in the electrolyte solvent market. The continuous evolution of battery technology suggests a dynamic landscape for electrolyte solvents, as they play a crucial role in the overall performance of next-generation batteries.

Rising Consumer Awareness and Demand for Performance

Rising consumer awareness regarding battery performance and safety is a crucial driver for the Lithium-ion Battery's Electrolyte Solvent Market. As consumers become more informed about the technology behind lithium-ion batteries, their expectations for performance, longevity, and safety increase. This heightened awareness is particularly evident in sectors such as consumer electronics and electric vehicles, where battery performance directly impacts user experience. Consequently, manufacturers are compelled to invest in high-quality electrolyte solvents that enhance battery efficiency and safety. Market data indicates that consumers are willing to pay a premium for products that offer superior performance, which may further incentivize manufacturers to prioritize the development of advanced electrolyte solvents. This trend underscores the importance of electrolyte solvents in meeting consumer demands and ensuring the competitiveness of lithium-ion batteries in various applications.