Rising Energy Demand

The Liquid Gas Market is poised for growth due to the rising energy demand across various sectors. As populations increase and economies develop, the need for reliable and efficient energy sources becomes more pronounced. Liquid gases, particularly LNG, are increasingly viewed as a viable solution to meet this growing demand. Data suggests that the energy sector is one of the largest consumers of liquid gases, with projections indicating a steady increase in consumption over the next decade. This trend is further fueled by the shift towards cleaner energy alternatives, as liquid gases offer a lower carbon footprint compared to traditional fuels. Consequently, the Liquid Gas Market is likely to experience robust growth as it adapts to the evolving energy landscape.

Increasing Industrial Applications

The Liquid Gas Market is experiencing a surge in demand due to its extensive applications across various industrial sectors. Industries such as manufacturing, chemicals, and food processing are increasingly utilizing liquid gases for their operational processes. For instance, liquid nitrogen is widely used in food preservation and packaging, while liquid oxygen is essential in steel manufacturing. The versatility of liquid gases allows for enhanced efficiency and productivity, which is crucial in competitive markets. As industries continue to expand and modernize, the reliance on liquid gases is likely to grow, further propelling the Liquid Gas Market. Recent data indicates that the industrial sector accounts for a substantial portion of liquid gas consumption, highlighting its pivotal role in driving market growth.

Regulatory Support for Clean Energy

The Liquid Gas Market is benefiting from a favorable regulatory environment that promotes the use of cleaner energy sources. Governments are increasingly implementing policies aimed at reducing carbon emissions and encouraging the adoption of alternative fuels. This regulatory support is particularly evident in the promotion of liquefied natural gas (LNG) as a cleaner alternative to traditional fossil fuels. The transition towards LNG is being facilitated by various incentives, including tax breaks and subsidies for infrastructure development. As a result, the Liquid Gas Market is likely to see a significant uptick in investments and projects aimed at expanding LNG facilities. This trend not only aligns with The Liquid Gas Industry as a key player in the energy transition.

Emerging Markets and Infrastructure Development

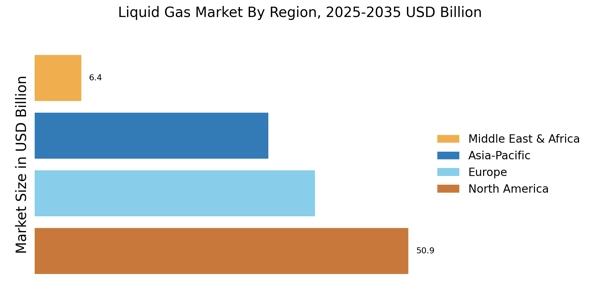

The Liquid Gas Market is witnessing significant growth driven by emerging markets and ongoing infrastructure development. Countries in Asia, Africa, and Latin America are investing heavily in energy infrastructure to support their economic growth. This includes the construction of LNG terminals, pipelines, and storage facilities, which are essential for the distribution of liquid gases. As these markets develop, the demand for liquid gases is expected to rise, creating new opportunities for suppliers and investors. Furthermore, the increasing urbanization and industrialization in these regions are likely to further bolster the Liquid Gas Market. The combination of infrastructure development and rising energy needs positions the Liquid Gas Market for substantial expansion in the coming years.

Technological Advancements in Storage and Transportation

Innovations in storage and transportation technologies are transforming the Liquid Gas Market. Enhanced methods for liquefaction, storage, and distribution are making it more efficient and cost-effective to transport liquid gases. For example, advancements in cryogenic technology have improved the safety and efficiency of transporting liquefied gases over long distances. Additionally, the development of specialized containers and pipelines has reduced the risk of leaks and spills, thereby increasing the reliability of supply chains. These technological improvements are likely to attract new investments and facilitate the expansion of the Liquid Gas Market. As companies seek to optimize their operations, the adoption of these advanced technologies is expected to play a crucial role in shaping the future landscape of the market.