Top Industry Leaders in the Linux Operating System Market

Competitive Landscape of the Linux Operating System Market

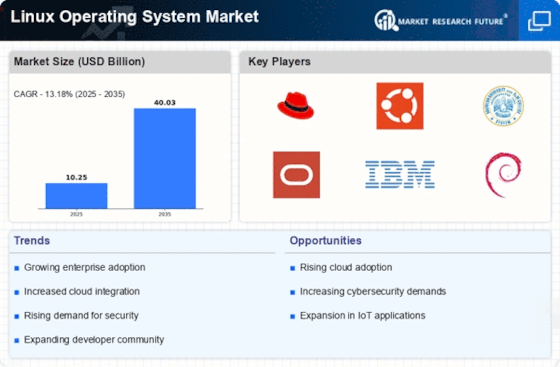

The Linux operating system (OS) market is experiencing significant growth, driven by its open-source nature, widespread adaptability, and increasing demand across diverse sectors. With a projected Compound Annual Growth Rate (CAGR) of 19.5%, the market is expected to reach substantial heights. This report delves into the competitive landscape, highlighting key players, strategies, market share factors, and emerging trends.

Key Players:

- Ubuntu (Canonical Ltd) (UK)

- IBM Corporation (US)

- elementary, Inc.

- Linux Mint (UK)

- Debian

- Arch Linux

- SUSE

- Manjaro

- Red Hat, Inc (US)

Strategies Adopted:

Key players in the Linux market adopt various strategies to differentiate themselves and gain market share. Some common strategies include:

- Focus on specific market segments: Companies like Red Hat and SUSE target the enterprise market with their high-quality, commercially supported distributions.

- User-friendliness and ease of use: Distributions like Ubuntu and Linux Mint prioritize user experience and ease of use, making them popular for desktops and non-technical users.

- Customization and flexibility: Arch Linux and other rolling-release distributions offer a high degree of customization and control, appealing to advanced users and developers.

- Open-source collaboration and community building: Many distributions actively engage with the open-source community to promote collaboration, innovation, and feedback.

- Partnerships and strategic alliances: Collaborations with hardware vendors, cloud providers, and other software companies can expand reach and enhance offerings.

Factors for Market Share Analysis:

Analyzing market share in the Linux OS market requires considering several factors:

- Distribution market share: Popular distributions like Ubuntu and CentOS enjoy significant user bases, while niche distributions cater to specific needs.

- Commercial vs. free distributions: Commercial distributions offer paid support and subscriptions, while free distributions rely on community-driven support.

- Desktop vs. server market: The server market presents a larger revenue opportunity compared to the desktop market, where competition is fierce.

- Cloud computing adoption: The growing cloud computing market presents an opportunity for Linux distributions optimized for cloud deployments.

- Regional differences: Market share can vary significantly across different regions due to factors like infrastructure development and user preferences.

New and Emerging Companies:

Alongside established players, new and emerging companies are entering the Linux market, bringing innovative solutions and catering to emerging trends:

- Cloud-native distributions: Companies like RancherOS and CoreOS offer lightweight distributions optimized for containerized workloads and cloud environments.

- Embedded Linux distributions: As the Internet of Things (IoT) grows, companies are developing specialized Linux distributions for embedded devices with limited resources.

- Security-focused distributions: With the increasing threat landscape, companies are creating distributions with enhanced security features and hardened configurations.

- Distributions for specific industries: Companies are developing Linux distributions tailored to the needs of specific industries, such as healthcare, finance, and education.

Current Company Investment Trends:

Several investment trends are currently shaping the Linux market:

- Increased focus on cloud infrastructure: Companies are investing in cloud-based solutions and services to cater to the growing demand for cloud computing.

- Open-source collaboration and partnerships: Companies are increasingly collaborating with each other and with the open-source community to share resources, develop new technologies, and promote innovation.

- Focus on security and compliance: As cybersecurity threats continue to evolve, companies are investing in security features and compliance solutions to meet regulatory requirements.

- Artificial intelligence and machine learning: Companies are integrating AI and ML into their offerings to automate tasks, improve performance, and personalize user experiences.

- Edge computing: The rise of edge computing is creating opportunities for specialized Linux distributions designed for resource-constrained environments.

Latest Company Updates:

China achieved a significant milestone in the development of autonomous software systems in 2023 when it released OpenKylin 1.0, the nation's first open-source desktop operating system (OS). The action will close the gap with leading Western technologies in the industry and is a part of the country's larger attempts to stand on its own two feet in terms of science and technology.

Leading supplier of immersive wireless sound technology for smart devices and next-generation home theatre systems, WiSA Technologies, Inc., announced in 2023 the release of two new tools for its customers that will expedite the creation and production of WiSA E and WiSA DS implementations. The new Product Support Engineering Tool (PEST) and the new WiSA Server work together to provide faster time-to-market and thorough testing and other areas of the manufacturing process.