Technological Innovations

Technological advancements play a crucial role in shaping the Lignocellulosic Fibers Market. Innovations in processing techniques, such as enzymatic treatments and advanced pulping methods, enhance the efficiency and quality of lignocellulosic fibers. These technologies not only improve yield but also reduce production costs, making lignocellulosic fibers more competitive against traditional materials. Market data suggests that the adoption of these technologies could lead to a substantial increase in production capacity, thereby meeting the rising demand from various sectors, including textiles and construction. As manufacturers invest in research and development, the Lignocellulosic Fibers Market is poised for significant growth, driven by enhanced product offerings and improved sustainability.

Growing Demand in Textiles

The textiles sector is witnessing a notable shift towards natural fibers, significantly impacting the Lignocellulosic Fibers Market. With consumers increasingly favoring sustainable and organic materials, the demand for lignocellulosic fibers, such as cotton and hemp, is on the rise. Market analysis indicates that the textiles industry is projected to expand, with lignocellulosic fibers expected to capture a larger market share due to their biodegradability and lower environmental impact. This trend is further supported by fashion brands committing to sustainable sourcing practices, which is likely to drive the growth of the Lignocellulosic Fibers Market. As a result, manufacturers are adapting their production strategies to align with consumer preferences, enhancing the overall market landscape.

Sustainability Initiatives

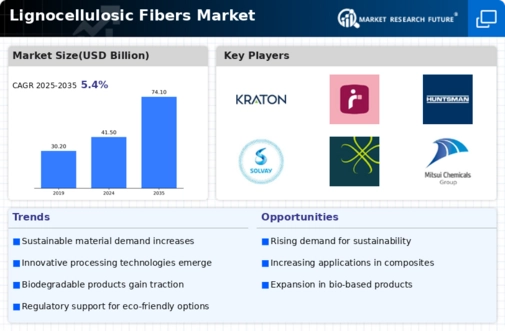

The increasing emphasis on sustainability is a pivotal driver for the Lignocellulosic Fibers Market. As industries strive to reduce their carbon footprints, lignocellulosic fibers, derived from renewable resources, present an eco-friendly alternative to synthetic fibers. This shift is evidenced by a growing number of companies adopting sustainable practices, which has led to a projected increase in the market size. Reports indicate that the demand for biodegradable materials is expected to rise, with the lignocellulosic fibers segment potentially capturing a significant share of the market. Furthermore, regulatory frameworks promoting sustainable materials are likely to bolster the growth of the Lignocellulosic Fibers Market, as manufacturers seek to comply with environmental standards.

Government Policies and Incentives

Government policies promoting the use of renewable resources are a significant driver for the Lignocellulosic Fibers Market. Various countries are implementing incentives for industries to adopt sustainable materials, which includes lignocellulosic fibers. These policies often manifest in the form of subsidies, tax breaks, or grants aimed at encouraging research and development in sustainable materials. As governments recognize the environmental benefits of lignocellulosic fibers, the regulatory landscape is becoming increasingly favorable. This supportive environment is likely to stimulate investment in the Lignocellulosic Fibers Market, fostering innovation and expanding production capabilities. Consequently, manufacturers are more inclined to explore lignocellulosic fibers as viable alternatives to conventional materials.

Rising Awareness of Environmental Issues

The growing awareness of environmental issues among consumers is driving the Lignocellulosic Fibers Market. As individuals become more conscious of the ecological impact of their choices, there is a marked shift towards products that are sustainable and environmentally friendly. This trend is reflected in the increasing demand for lignocellulosic fibers, which are perceived as a greener alternative to synthetic fibers. Market trends indicate that consumers are willing to pay a premium for products made from renewable resources, thereby encouraging manufacturers to incorporate lignocellulosic fibers into their offerings. This heightened awareness is likely to propel the Lignocellulosic Fibers Market forward, as companies adapt to meet the evolving preferences of environmentally conscious consumers.