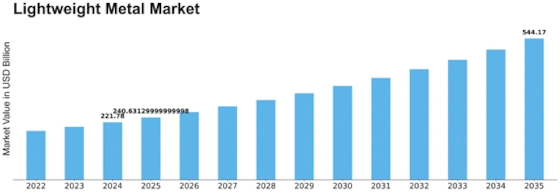

Lightweight Metal Size

Lightweight Metal Market Growth Projections and Opportunities

The Lightweight Metal Market is shaped by a diverse set of market factors contributing to its growth and dynamics. A significant driver is the increasing demand for lightweight materials in various industries, particularly automotive and aerospace. Lightweight metals, such as aluminum, magnesium, and titanium, offer a compelling solution for manufacturers seeking to improve fuel efficiency, reduce emissions, and enhance overall performance. In the automotive sector, lightweight metals play a pivotal role in the development of fuel-efficient vehicles, while in aerospace, they are instrumental in achieving higher fuel efficiency and reducing the overall weight of aircraft, contributing to sustainability goals.

Moreover, technological advancements in metallurgy and manufacturing processes contribute significantly to market dynamics. Continuous research and development efforts focus on enhancing the strength, durability, and formability of lightweight metals. Innovations in alloy compositions, heat treatment methods, and fabrication techniques expand the range of applications for lightweight metals in structural components, engine parts, and consumer electronics. Technological advancements drive the adoption of lightweight metals as viable alternatives to traditional materials across industries.

The automotive industry's push toward electric vehicles (EVs) and the development of sustainable transportation solutions further influence the Lightweight Metal Market. As the automotive landscape undergoes a transformation towards electric and hybrid vehicles, the demand for lightweight materials becomes even more critical. Lightweight metals are essential in offsetting the weight of batteries in electric vehicles, contributing to extended driving range and improved overall efficiency. The global shift towards sustainable mobility and stringent emissions regulations amplify the importance of lightweight metals in the automotive sector.

Global economic conditions and trade dynamics impact the Lightweight Metal Market. As a globally traded commodity, factors such as international trade agreements, tariffs, and geopolitical events can influence the supply chain and market conditions for lightweight metals. Economic stability, manufacturing trends, and trade policies play a role in determining the accessibility and cost competitiveness of lightweight metals in the market.

Environmental considerations and regulatory standards also play a significant role in shaping the lightweight metal market. The emphasis on sustainability and the reduction of carbon emissions drive industries to adopt materials that contribute to eco-friendly practices. Lightweight metals align with environmental goals by reducing the overall weight of vehicles and structures, leading to lower energy consumption and emissions. Compliance with environmental regulations ensures that the production and use of lightweight metals adhere to the highest standards of sustainability.

Market competition and industry collaborations are notable factors influencing the Lightweight Metal Market. The market comprises established metal producers, manufacturers, and emerging players, fostering a competitive landscape. Collaboration between lightweight metal producers, original equipment manufacturers (OEMs), and research institutions facilitates the development of new alloys, fabrication methods, and applications. Partnerships across the industry supply chain contribute to knowledge exchange, innovation, and the overall advancement of lightweight metal solutions.

Challenges related to cost considerations, recycling infrastructure, and the development of advanced manufacturing technologies are factors that the lightweight metal industry addresses. While lightweight metals offer numerous advantages, the cost of production and processing can be higher than traditional materials. Efforts to optimize production processes, reduce costs, and enhance recycling technologies are ongoing challenges for the industry. The development of advanced manufacturing techniques, such as additive manufacturing and innovative joining methods, is essential for expanding the application areas and improving the cost-effectiveness of lightweight metals.

Leave a Comment