Rising Demand for Diagnostic Tools

The Life Science Tools Market is experiencing a notable increase in demand for diagnostic tools, driven by the need for early disease detection and personalized treatment options. As healthcare systems evolve, there is a growing emphasis on precision medicine, which necessitates advanced diagnostic capabilities. The market for diagnostic tools is projected to reach approximately USD 50 billion by 2026, reflecting a compound annual growth rate of around 7%. This trend underscores the importance of innovative technologies in enhancing patient outcomes and streamlining healthcare processes. Consequently, companies within the Life Science Tools Market are investing heavily in research and development to create cutting-edge diagnostic solutions that cater to diverse medical needs.

Increased Investment in Biotechnology

Investment in biotechnology is a significant driver for the Life Science Tools Market, as it fuels innovation and the development of new tools and technologies. Venture capital funding for biotech firms has surged, with estimates indicating that investments reached over USD 20 billion in the past year alone. This influx of capital enables companies to enhance their research capabilities and expand their product offerings. As biotechnology continues to advance, the demand for specialized life science tools that support research and development activities is likely to grow. This trend not only benefits established players in the Life Science Tools Market but also paves the way for new entrants to innovate and compete.

Growing Focus on Genomics and Proteomics

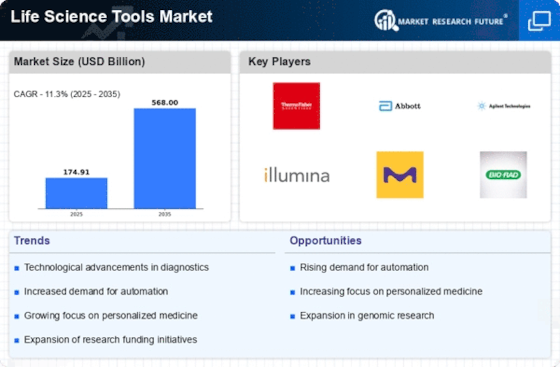

The Life Science Tools Market is witnessing a growing focus on genomics and proteomics, driven by advancements in sequencing technologies and bioinformatics. The Life Science Tools Market is projected to reach USD 62 billion by 2026, indicating a robust growth trajectory. This surge is largely attributed to the increasing application of genomic data in drug discovery, personalized medicine, and disease prevention. As researchers seek to understand complex biological systems, the demand for tools that facilitate genomic and proteomic analysis is expected to rise. Consequently, companies in the Life Science Tools Market are prioritizing the development of innovative solutions that cater to these evolving research needs.

Regulatory Support for Research and Development

Regulatory support plays a crucial role in shaping the Life Science Tools Market, as governments worldwide implement policies that encourage research and development. Initiatives aimed at streamlining the approval process for new tools and technologies are becoming more prevalent, fostering an environment conducive to innovation. For instance, regulatory agencies are increasingly adopting frameworks that expedite the review of life science products, thereby reducing time-to-market for new solutions. This supportive regulatory landscape is likely to enhance the competitiveness of companies within the Life Science Tools Market, enabling them to bring innovative products to market more efficiently and effectively.

Emerging Markets and Expanding Research Infrastructure

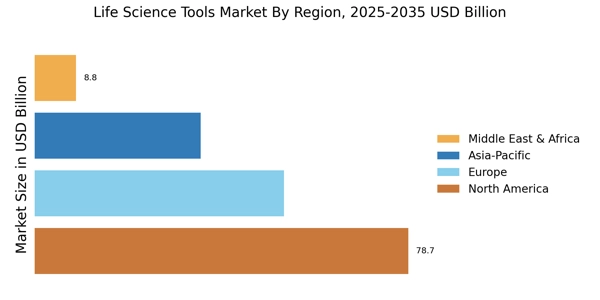

Emerging markets are becoming increasingly important for the Life Science Tools Market, as they invest in expanding their research infrastructure. Countries in Asia and Latin America are witnessing significant growth in their life sciences sectors, driven by government initiatives and private investments. This expansion is expected to create new opportunities for life science tool manufacturers, as demand for advanced research capabilities rises. The market in these regions is projected to grow at a compound annual growth rate of over 8% in the coming years. As research institutions and laboratories proliferate, the Life Science Tools Market is likely to benefit from increased sales and adoption of innovative tools tailored to local needs.