Innovation in Treatment Products

Innovation in lice treatment products significantly influences the Global Lice Treatment Market Industry. The introduction of new formulations, such as natural and chemical-free options, caters to the growing consumer preference for safer alternatives. Companies are increasingly investing in research and development to create effective treatments that minimize side effects. For instance, products utilizing essential oils and botanical extracts are gaining traction among health-conscious consumers. This trend not only enhances product offerings but also attracts a broader customer base. As a result, the market is anticipated to grow at a CAGR of 7.28% from 2025 to 2035, reflecting the impact of innovation on market dynamics.

Increased Awareness and Education

In the Global Lice Treatment Market Industry, increased awareness and education regarding lice prevention and treatment play a crucial role in driving market growth. Educational campaigns by health organizations and schools emphasize the importance of early detection and treatment of lice infestations. This heightened awareness encourages parents to seek out effective lice treatment products, thereby expanding the market. Furthermore, the availability of information through various channels, including social media and healthcare providers, contributes to informed decision-making. As a result, the market is expected to grow significantly, with projections indicating a rise to 0.25 USD Billion by 2035.

Regulatory Support and Guidelines

Regulatory support and guidelines from health authorities contribute to the growth of the Global Lice Treatment Market Industry. Governments and health organizations provide recommendations for effective lice management, which often includes the use of approved treatment products. This regulatory framework ensures that consumers have access to safe and effective solutions. Additionally, guidelines for schools and childcare facilities regarding lice management foster a proactive approach to addressing infestations. As these regulations become more stringent, manufacturers are encouraged to comply, leading to an increase in the availability of quality products in the market. This supportive environment is likely to enhance market growth in the coming years.

Market Trends and Growth Projections

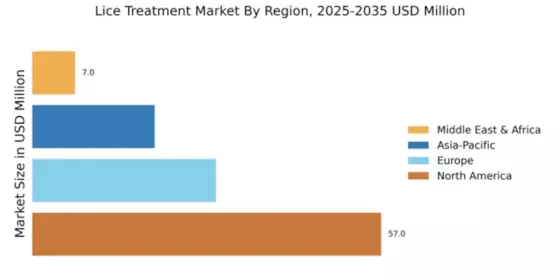

The Global Lice Treatment Market Industry is characterized by several key trends and growth projections. The market is expected to reach 0.11 USD Billion in 2024, with a projected increase to 0.25 USD Billion by 2035. This growth trajectory suggests a robust demand for lice treatment solutions, driven by factors such as rising infestation rates and increased consumer awareness. The anticipated CAGR of 7.28% from 2025 to 2035 further underscores the market's potential for expansion. These trends indicate a dynamic landscape, where innovation and consumer preferences will shape the future of lice treatment solutions.

Rising Incidence of Lice Infestations

The Global Lice Treatment Market Industry experiences a notable increase in demand due to the rising incidence of lice infestations, particularly among school-aged children. Reports indicate that approximately 6 to 12 million infestations occur annually in the United States alone, highlighting a persistent public health concern. This trend is likely to drive the market, as parents seek effective treatment options. The growing awareness of lice transmission in schools and communities further amplifies the need for effective lice treatment solutions. Consequently, the market is projected to reach 0.11 USD Billion in 2024, reflecting the urgent need for effective lice management.

Market Penetration of Over-the-Counter Products

The Global Lice Treatment Market Industry benefits from the increasing market penetration of over-the-counter (OTC) lice treatment products. The convenience and accessibility of these products allow consumers to address lice infestations promptly without the need for a prescription. Retailers are expanding their offerings, making a variety of OTC treatments readily available in pharmacies and online platforms. This trend not only meets consumer demand but also encourages self-treatment, which may lead to higher sales volumes. As a result, the market is poised for growth, with the potential for increased revenue generation as more consumers opt for OTC solutions.