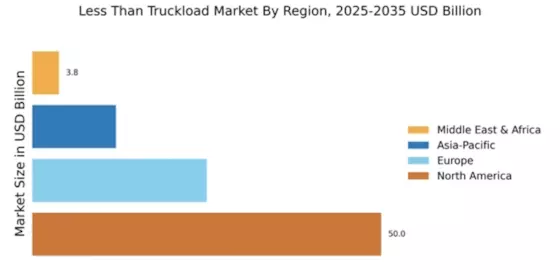

North America : Market Leader in LTL Services

North America continues to lead the Less Than Truckload (LTL) market, holding a significant share of 50.0% as of December 2025. The growth is driven by increasing e-commerce activities, demand for efficient logistics solutions, and favorable regulatory frameworks. The region's robust infrastructure and technological advancements further enhance operational efficiencies, making it a prime market for LTL services.

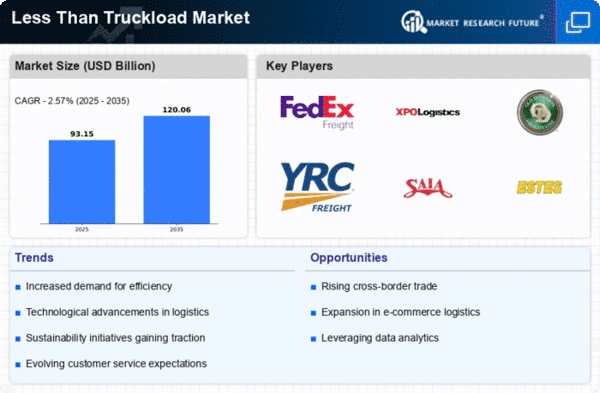

The competitive landscape is characterized by major players such as FedEx Freight, XPO Logistics, and Old Dominion Freight Line, which dominate the market. These companies leverage advanced logistics technologies and extensive networks to meet the growing demand. The U.S. remains the largest contributor, with a strong focus on innovation and customer service, ensuring sustained growth in the LTL sector.

Europe : Emerging Market with Growth Potential

Europe's Less Than Truckload (LTL) market is poised for growth, currently holding a market size of 25.0%. The region benefits from increasing cross-border trade, regulatory support for logistics efficiency, and a shift towards sustainable transport solutions. The European Union's initiatives to enhance transport infrastructure and reduce emissions are key drivers of this market expansion.

Leading countries such as Germany, France, and the UK are at the forefront of this growth, with a competitive landscape featuring companies like DB Schenker and DPD. The presence of established logistics networks and a focus on digital transformation are enhancing service offerings. As the market evolves, regulatory frameworks will continue to play a crucial role in shaping the future of LTL services in Europe.

Asia-Pacific : Rapidly Growing Logistics Hub

The Asia-Pacific region is witnessing rapid growth in the Less Than Truckload (LTL) market, with a market size of 12.0%. This growth is fueled by increasing urbanization, rising e-commerce demand, and improvements in logistics infrastructure. Governments are investing in transport networks and regulatory reforms to enhance efficiency and reduce costs, which are critical for the LTL sector's expansion.

Countries like China, Japan, and India are leading the charge, with a competitive landscape that includes both local and international players. Companies are focusing on technology adoption and service diversification to meet the evolving needs of customers. The region's dynamic market conditions present significant opportunities for growth in the LTL space, driven by innovation and customer-centric strategies.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa (MEA) region, with a market size of 3.82%, is an emerging player in the Less Than Truckload (LTL) market. Growth is driven by increasing trade activities, urbanization, and investments in logistics infrastructure. However, challenges such as regulatory hurdles and varying levels of infrastructure development can impact market dynamics. Governments are working to improve logistics frameworks to support growth in this sector.

Countries like South Africa and the UAE are leading the market, with a mix of local and international logistics providers. The competitive landscape is evolving, with companies focusing on enhancing service quality and operational efficiency. As the region continues to develop, the LTL market is expected to grow, driven by strategic investments and partnerships.