Growing Awareness and Education

The rising awareness and education surrounding atrial fibrillation and its associated risks are pivotal in driving the Left Atrial Appendage Closure Device Market. Healthcare campaigns aimed at educating both patients and providers about the implications of AF have led to increased screening and diagnosis rates. As patients become more informed about their treatment options, including left atrial appendage closure devices, the likelihood of seeking these interventions rises. Market Research Future suggests that regions with active educational initiatives have seen a notable increase in device adoption. This trend indicates that as awareness continues to grow, the Left Atrial Appendage Closure Device Market will likely expand, fueled by informed patient choices and proactive healthcare measures.

Increasing Geriatric Population

The growing geriatric population is a significant factor influencing the Left Atrial Appendage Closure Device Market. Older adults are at a higher risk for atrial fibrillation and related complications, leading to an increased demand for effective management solutions. As the global population ages, the incidence of AF is projected to rise, thereby driving the need for left atrial appendage closure devices. Market data indicates that the elderly demographic is expected to expand substantially in the coming years, with projections suggesting that by 2030, nearly 1 in 6 individuals will be aged 65 or older. This demographic shift is likely to create a robust market for left atrial appendage closure devices, as healthcare systems adapt to meet the needs of this vulnerable population.

Regulatory Support and Approvals

Regulatory support and timely approvals for left atrial appendage closure devices are crucial drivers of the Left Atrial Appendage Closure Device Market. Regulatory bodies are increasingly recognizing the importance of these devices in preventing stroke among AF patients. Recent approvals of innovative devices have streamlined the pathway for market entry, encouraging manufacturers to invest in research and development. This supportive regulatory environment not only fosters innovation but also enhances market confidence. As more devices receive regulatory clearance, the Left Atrial Appendage Closure Device Market is expected to witness accelerated growth, as healthcare providers gain access to a broader range of effective treatment options.

Rising Incidence of Atrial Fibrillation

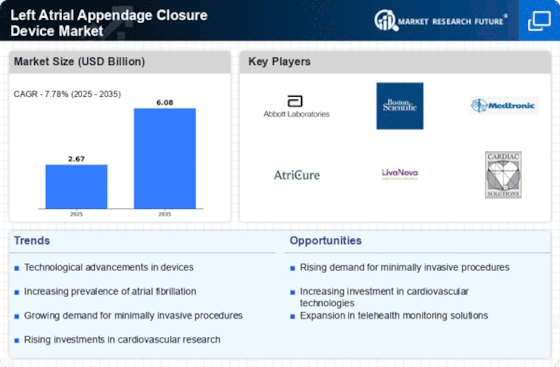

The increasing prevalence of atrial fibrillation (AF) is a primary driver for the Left Atrial Appendage Closure Device Market. AF affects millions worldwide, leading to a heightened risk of stroke. According to recent estimates, approximately 33 million individuals are diagnosed with AF globally. This growing patient population necessitates effective management strategies, including the use of left atrial appendage closure devices. As healthcare providers seek to mitigate stroke risks associated with AF, the demand for these devices is expected to rise. Furthermore, advancements in device technology and improved patient outcomes are likely to enhance adoption rates, thereby propelling market growth. The Left Atrial Appendage Closure Device Market is poised to benefit significantly from this trend, as more patients seek innovative solutions to manage their condition.

Technological Innovations in Device Design

Technological advancements in the design and functionality of left atrial appendage closure devices are significantly influencing the Left Atrial Appendage Closure Device Market. Innovations such as improved delivery systems, enhanced biocompatibility, and advanced imaging techniques are making procedures safer and more effective. For instance, the introduction of devices that can be deployed via minimally invasive techniques has expanded their applicability. Market data indicates that the adoption of these innovative devices is expected to increase, with a projected compound annual growth rate (CAGR) of over 10% in the coming years. As healthcare providers increasingly recognize the benefits of these advancements, the Left Atrial Appendage Closure Device Market is likely to experience robust growth, driven by the demand for cutting-edge solutions.