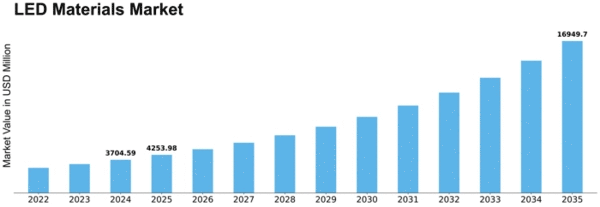

Led Materials Size

LED Materials Market Growth Projections and Opportunities

LED Materials Market capitalization is slated to touch USD 22.68 Billion by 2027, as per an in-depth report by Market Research Future (MRFR), period (2021-2027) owing to the growing demand for energy-efficient lights.

The LED materials market is significantly influenced by several market factors that shape its growth trajectory. One pivotal aspect is the rapid advancements in technology. As technological innovations continue to surge forward, the demand for more efficient, durable, and cost-effective LED materials rises. This demand fuels research and development efforts, pushing manufacturers to create materials that offer better performance, longer lifespan, and enhanced energy efficiency.

Another critical factor is the global push towards sustainability and energy efficiency. LED technology aligns perfectly with these goals due to its lower energy consumption and longer lifespan compared to traditional lighting options. Consequently, government initiatives and regulations promoting energy-efficient lighting solutions significantly impact the LED materials market. Subsidies, tax incentives, and regulatory frameworks that encourage the adoption of LEDs drive market growth.

Market dynamics are also shaped by the increasing adoption of LEDs across various industries. From residential and commercial lighting to automotive and electronics sectors, LEDs are becoming the preferred choice. This growing adoption across diverse applications creates a steady demand for LED materials, prompting manufacturers to scale up production and innovation.

The competitive landscape plays a pivotal role in shaping the LED materials market. With numerous players in the industry, competition is fierce, driving companies to differentiate their products through quality, performance, and pricing. This competitive environment spurs constant innovation, leading to the development of new materials and manufacturing techniques that enhance LED performance and reduce production costs.

Moreover, the economic landscape and consumer behavior significantly influence the LED materials market. Economic stability, disposable income levels, and consumer preferences impact the demand for LED lighting solutions. Price sensitivity remains a key consideration for consumers, influencing their choices between traditional lighting and LED alternatives. Market players must balance quality and cost-effectiveness to cater to varying consumer segments.

Furthermore, supply chain dynamics, including raw material availability and pricing, exert a considerable influence on the LED materials market. The accessibility and cost of essential materials, such as semiconductor materials, phosphors, and substrates, directly impact manufacturing costs and, subsequently, the pricing of LED products in the market.

Geopolitical factors, trade policies, and international relations also play a role in shaping the LED materials market. Tariffs, trade restrictions, and geopolitical tensions can disrupt supply chains, affecting the availability and pricing of LED materials. Moreover, regional differences in regulations and standards influence market strategies and product offerings to comply with varying requirements across different markets.

Leave a Comment