Customization Trends

Customization and personalization are becoming pivotal in the Leather Dyes Market. As consumers seek unique products that reflect their individual styles, the demand for customized leather goods is surging. This trend is particularly pronounced in sectors such as fashion and automotive, where personalized leather items command premium prices. Market data indicates that the customization segment is expected to account for approximately 30% of the total leather dye sales by 2026. This shift is driving manufacturers to develop versatile dye formulations that can cater to a wide range of colors and finishes. Consequently, companies that embrace customization are likely to gain a competitive edge, as they can meet the evolving preferences of consumers in the Leather Dyes Market.

Regulatory Compliance

Regulatory compliance is becoming increasingly critical in the Leather Dyes Market, as governments worldwide implement stricter environmental and safety standards. Manufacturers are required to adhere to regulations concerning the use of hazardous chemicals in dye formulations, which is driving innovation towards safer alternatives. Compliance with these regulations not only ensures market access but also enhances brand reputation among environmentally conscious consumers. Data indicates that companies investing in compliance and sustainable practices are likely to see a 15% increase in market share over the next few years. As the regulatory landscape continues to evolve, companies that proactively adapt to these changes will be better positioned to thrive in the competitive Leather Dyes Market.

Technological Innovations

Technological advancements are reshaping the Leather Dyes Market, leading to more efficient and sustainable dyeing processes. Innovations such as digital printing and advanced dyeing techniques are enabling manufacturers to produce high-quality leather with reduced environmental impact. For instance, digital dyeing technology allows for precise color application, minimizing waste and enhancing color vibrancy. Market analysis suggests that the adoption of such technologies could reduce dyeing water consumption by up to 50%, which is a significant improvement. Additionally, the integration of automation in dyeing processes is streamlining production, thereby increasing output and reducing costs. As these technologies continue to evolve, they are likely to play a crucial role in the future landscape of the Leather Dyes Market.

Sustainability Initiatives

The Leather Dyes Market is increasingly influenced by sustainability initiatives. As consumers become more environmentally conscious, manufacturers are compelled to adopt eco-friendly dyeing processes. This shift is evident in the rising demand for natural and organic dyes, which are perceived as less harmful to the environment. According to recent data, the market for sustainable leather dyes is projected to grow at a compound annual growth rate of 8% over the next five years. This trend not only aligns with consumer preferences but also encourages companies to innovate in their production methods, thereby enhancing their market position. Furthermore, regulatory pressures regarding chemical usage in dyeing processes are prompting manufacturers to invest in sustainable practices, which could reshape the Leather Dyes Market significantly.

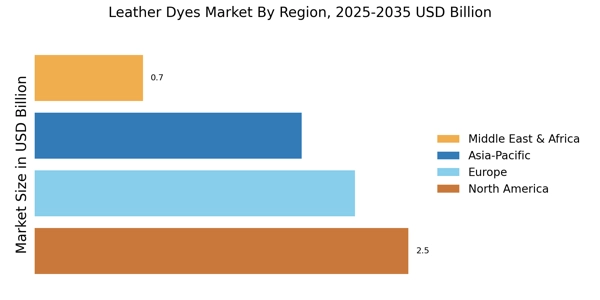

Rising Demand in Emerging Markets

The Leather Dyes Market is witnessing a surge in demand from emerging markets, where economic growth is driving increased consumption of leather products. Countries in Asia and Latin America are experiencing a rise in disposable income, leading to greater spending on fashion and luxury goods. This trend is reflected in the leather goods market, which is projected to grow at a rate of 7% annually in these regions. Consequently, the demand for high-quality leather dyes is expected to rise correspondingly, as manufacturers seek to meet the needs of a more affluent consumer base. This shift presents both opportunities and challenges for existing players in the Leather Dyes Market, as they must adapt to the preferences and expectations of consumers in these rapidly developing markets.