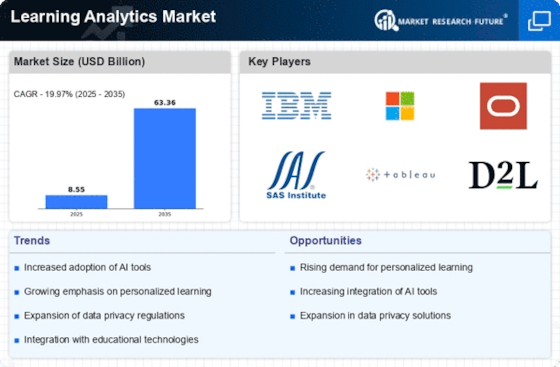

Learning Analytics Size

Learning Analytics Market Growth Projections and Opportunities

Many things generally influence the development and growth of the Learning Analytics market. One of the main market factors is the increased adoption of digital learning platforms in educational institutions and corporate organizations. The need for learning analytics tools has spiked as conventional methods of learning transition to online and virtual environments. Additionally, increasing awareness and the significance of personalized learning greatly contribute to the expansion of the Learning Analytics market. Both educational institutions and businesses know how important it is to customize learning experiences to suit individual needs or preferences. During this customization process, learning analytics solutions analyze data to identify specific patterns, strengths, and areas requiring improvement with respect to learning. Thus, institutions can develop individualized paths for learners that enhance the overall effectiveness of education and training programs. Another important factor that influences this market is a growing emphasis on lifelong learning and professional development. People, both individuals and the organization's working space, have become so dynamic, hence making them understand that there are times they need to upskill themselves or reskill themselves. Learning analytics support skills acquisition monitoring, qualification attainment, and progress tracking, which offers valuable feedback loops for students, customers, clients, users, educators, facilitators, trainers, and coaches alike. On top of this aspect lies the significance of data-driven decision-making in education administration management, resulting in increased demand for the Learning Analytics marketing sector worldwide, where school systems are increasingly relying on data linked to student performance. Additionally, another forceful market factor emerges from combining artificial intelligence (AI) technology with machine language (ML). These technologies empower predictive analytics and smart insights within the range offered by learning analytics solutions. Predictive analytics may also be used to predict student or team member performance, thereby enabling schools to take timely interventions against possible challenges before they emerge once more into being full-blown problems requiring serious actions by all stakeholders involved hereunder towards eliminating them. Besides these factors, there also exist other contributing forces causing dynamics in the Learning Analytics Market about the regulatory framework's landscape, including compliance requirements. Various regulations and standards on data protection and privacy have to be followed by educational institutions and firms. Therefore, learning analytics developers must come up with solutions that not only provide robust analytics but also guarantee the security of students' sensitive information. Adherence to these regulations becomes a major determinant when it comes to selecting learning analytics tools.

Leave a Comment