Rise of Data-Driven Decision Making

In the Learning Analytics Market, there is a notable rise in data-driven decision making among educational institutions. Administrators and educators are increasingly utilizing analytics to inform their strategies and improve educational outcomes. This trend is supported by the growing availability of data analytics tools that allow institutions to analyze student performance metrics and engagement levels. Research indicates that institutions employing data-driven strategies can achieve a 20% improvement in retention rates. Consequently, the emphasis on data-driven decision making is expected to propel the demand for learning analytics solutions, as institutions strive to optimize their educational offerings and enhance overall student success.

Increased Focus on Student Retention

The Learning Analytics Market is experiencing an increased focus on student retention, prompting educational institutions to adopt analytics solutions. Retaining students is a critical challenge for many institutions, and learning analytics provides valuable insights into factors influencing student dropout rates. By analyzing data related to student engagement, performance, and demographics, institutions can identify at-risk students and implement targeted interventions. Studies suggest that institutions utilizing learning analytics to enhance retention strategies can see a 15% reduction in dropout rates. This focus on retention is likely to drive further investment in learning analytics tools, as institutions seek to create supportive environments that promote student success.

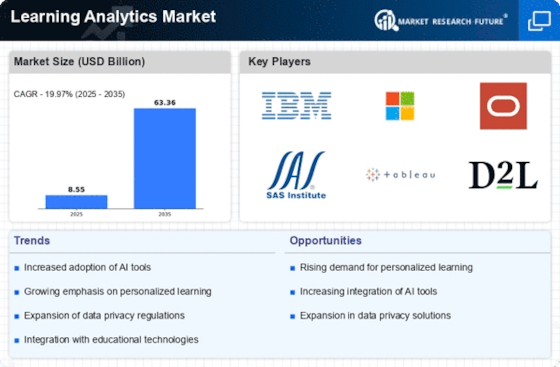

Growing Demand for Personalized Learning

The Learning Analytics Market is witnessing a growing demand for personalized learning experiences. Educational institutions are increasingly recognizing the importance of tailoring educational content to meet individual student needs. This trend is driven by the need to enhance student engagement and improve learning outcomes. According to recent data, personalized learning approaches can lead to a 30% increase in student performance. As a result, educational institutions are investing in learning analytics tools that provide insights into student behavior and preferences, enabling them to create customized learning paths. This shift towards personalization is likely to continue, as more institutions seek to leverage data-driven insights to foster a more effective learning environment.

Regulatory Compliance and Accountability

The Learning Analytics Market is also influenced by regulatory compliance and accountability measures that educational institutions must adhere to. As governments and accrediting bodies emphasize the importance of data transparency and accountability in education, institutions are increasingly turning to learning analytics to meet these requirements. Analytics tools enable institutions to track and report on student performance and outcomes, ensuring compliance with regulatory standards. This trend is further supported by the growing demand for accountability in educational outcomes, as stakeholders seek assurance that institutions are effectively utilizing resources to enhance student learning. Consequently, the need for compliance and accountability is likely to drive the adoption of learning analytics solutions.

Advancements in Technology Infrastructure

The Learning Analytics Market is benefiting from advancements in technology infrastructure, which facilitate the implementation of learning analytics solutions. The proliferation of cloud computing, big data technologies, and machine learning algorithms has made it easier for educational institutions to collect, store, and analyze vast amounts of data. This technological evolution allows for real-time analytics and insights, which are crucial for timely interventions in student learning. As institutions upgrade their technological capabilities, the demand for sophisticated learning analytics tools is likely to increase. Furthermore, the integration of these technologies can lead to improved educational outcomes, as institutions can better understand and respond to student needs.