Rising Demand for Automotive Batteries

The increasing demand for automotive batteries, particularly in the context of the Lead Acid Battery Separator for SLI Application Market, is a primary driver. As the automotive sector continues to expand, the need for reliable starting, lighting, and ignition (SLI) batteries grows. In 2025, the automotive battery market is projected to reach a valuation of approximately USD 80 billion, with lead acid batteries maintaining a significant share due to their cost-effectiveness and established technology. This trend suggests that the Lead Acid Battery Separator for SLI Application Market will experience heightened demand as manufacturers seek to enhance battery performance and longevity, thereby driving innovation in separator technologies.

Growth of Renewable Energy Storage Solutions

The growth of renewable energy storage solutions is emerging as a key driver for the Lead Acid Battery Separator for SLI Application Market. As the world shifts towards renewable energy sources, the need for efficient energy storage systems becomes paramount. Lead acid batteries, with their established technology and cost advantages, are increasingly being utilized for energy storage applications. The market for energy storage systems is projected to reach USD 20 billion by 2026, with lead acid batteries playing a crucial role. This trend suggests that the Lead Acid Battery Separator for SLI Application Market will benefit from the rising demand for separators that enhance the performance and reliability of lead acid batteries in energy storage applications.

Technological Advancements in Battery Design

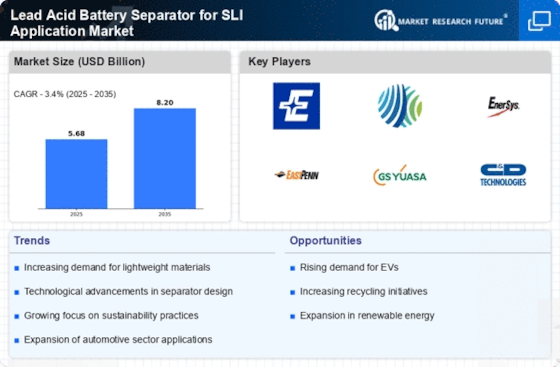

Technological advancements in battery design are influencing the Lead Acid Battery Separator for SLI Application Market. Innovations such as improved separator materials and manufacturing processes are enhancing the efficiency and safety of lead acid batteries. For instance, the introduction of advanced polymer separators has been shown to improve the thermal stability and reduce the risk of short circuits. As battery manufacturers adopt these new technologies, the demand for high-quality separators is likely to increase. The market for lead acid battery separators is expected to grow at a compound annual growth rate (CAGR) of around 5% over the next few years, indicating a robust opportunity for suppliers in the Lead Acid Battery Separator for SLI Application Market.

Increased Focus on Automotive Electrification

Increased focus on automotive electrification is driving changes in the Lead Acid Battery Separator for SLI Application Market. As automakers transition towards electric and hybrid vehicles, the demand for efficient and reliable lead acid batteries remains relevant for auxiliary functions. The integration of lead acid batteries in electric vehicles for starting and auxiliary power applications is expected to grow, with the market for lead acid batteries in this segment projected to reach USD 10 billion by 2027. This shift indicates that the Lead Acid Battery Separator for SLI Application Market will likely see increased investment in separator technologies that cater to the evolving needs of the automotive sector.

Regulatory Support for Lead Acid Battery Recycling

Regulatory support for lead acid battery recycling is a significant driver for the Lead Acid Battery Separator for SLI Application Market. Governments worldwide are implementing stringent regulations to promote the recycling of lead acid batteries, which are known for their high recyclability rates. This regulatory framework not only encourages sustainable practices but also ensures a steady supply of recycled materials for battery production. In 2025, it is estimated that over 95% of lead acid batteries are recycled, creating a robust market for separators that can withstand the recycling process. This trend is likely to bolster the Lead Acid Battery Separator for SLI Application Market as manufacturers align their products with regulatory requirements.