Top Industry Leaders in the Language Translation Software Market

Competitive Landscape of Language Translation Software Market

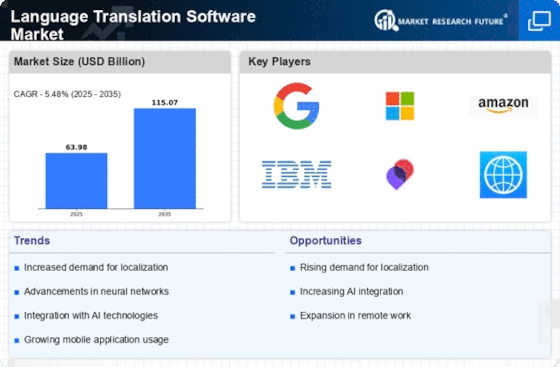

The language translation software market is a fast-paced and dynamic arena experiencing robust growth fueled by globalization, advancements in AI and machine learning, and increasing demand for seamless cross-cultural communication. Here, we delve into the competitive landscape, key players, and the factors shaping market share:

Key Players:

- Lionbridge Technologies, Inc. (U.S.)

- Bigword Group Ltd. (England)

- Languageline Solutions (U.S.)

- Google Inc. (U.S.)

- IBM Corporation (U.S.)

- Global Linguist Solutions (U.S.)

- Babylon Corporation (Israel)

- Microsoft Inc. (U.S.)

- Systran (South Korea)

- Cloudwords Inc. (U.S.)

Strategies for Market Dominance:

- Technological Advancements: Continuous investment in AI, neural machine translation (NMT), and natural language processing (NLP) is crucial for enhancing accuracy, fluency, and domain-specific expertise.

- Localization Focus: Adapting software to cater to cultural nuances and linguistic variations of different regions opens up broader market access.

- Integration and Partnerships: Partnerships with LSPs, other software providers, and content management systems create a robust ecosystem and expand service reach.

- Subscription and Cloud-based Models: Flexible pricing models like SaaS (Software as a Service) cater to diverse user needs and budgets, driving wider adoption.

- Security and Data Privacy: Addressing data security concerns through robust encryption and transparent privacy policies is essential for building trust and compliance.

Factors for Market Share Analysis:

- Revenue and Market Share: Tracking major players' revenue and market share provides insights into their competitive positioning and growth trajectory.

- Technology Leadership: Assessing advancements in translation engines, NMT capabilities, and NLP integration reveals innovative prowess and potential market disruption.

- Global Reach and Localization: Analyzing the number of supported languages, regional adaptation strategies, and partnerships in key markets paints a picture of geographical dominance.

- Customer Base and Industry Focus: Understanding the types of users (individuals, businesses, LSPs) and vertical market specializations indicates target segments and growth potential.

New and Emerging Companies:

- Start-ups like XTM Cloud and Mate Translate are utilizing advanced AI and cloud technologies to offer specialized solutions for multilingual content creation and communication.

- Companies focusing on low-resource languages or niche domains like legal or medical translation are creating a competitive edge through targeted expertise.

- Open-source translation platforms like Tatoeba and Linguee are gaining traction by offering community-driven content and collaborative translation efforts.

Current Company Investment Trends:

- M&A Activity: Acquisitions and mergers are consolidating the market, with established players acquiring niche solutions or smaller competitors to expand their offerings and reach.

- Strategic Partnerships: Collaborations with technology giants, cloud providers, and content platforms are fostering innovation and access to diverse user bases.

- Focus on Vertical Integration: Developing and acquiring complementary software solutions like content management systems, localization tools, and terminology management platforms are creating comprehensive translation ecosystems.

- Investment in AI and R&D: Continuous research and development in NMT, NLP, and domain-specific language models are key to maintaining technological leadership and market advantage.

Latest Company Updates:

December 2023: Google announces advancements in its NMT system, improving translation accuracy for low-resource languages and specialized domains like healthcare and legal documents.

November 2023: This collaboration integrates Microsoft Translator into WeChat's messaging platform, enabling seamless communication between Chinese and international users.

October 2023: Independent tests reveal DeepL's translation engine as slightly more accurate on average, highlighting the growing competition in the market.

September 2023: This acquisition consolidates Memsource's position as a leading LSP software provider, expanding its product offerings and global reach.