Market Growth Projections

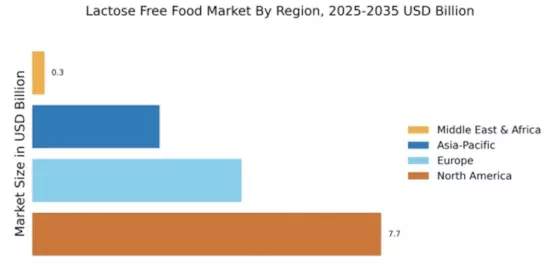

The Global Lactose Free Food Industry is poised for substantial growth, with projections indicating a market value of 18.7 USD Billion by 2035. This growth trajectory is supported by a compound annual growth rate (CAGR) of 8.88% from 2025 to 2035. The increasing prevalence of lactose intolerance, coupled with rising health consciousness and innovative product development, contributes to this positive outlook. As consumers continue to seek lactose-free options, the market is expected to expand significantly, reflecting broader dietary trends and changing consumer preferences.

Innovative Product Development

Innovation in product development plays a crucial role in shaping the Global Lactose Free Food Industry. Manufacturers are increasingly investing in research and development to create a diverse range of lactose-free products that cater to various consumer preferences. This includes lactose-free cheeses, yogurts, and ice creams that maintain taste and texture comparable to their traditional counterparts. The introduction of fortified lactose-free options, enriched with vitamins and minerals, further enhances their appeal. Such innovations not only attract lactose-intolerant consumers but also health-conscious individuals, thereby expanding the market's reach and contributing to its projected CAGR of 8.88% from 2025 to 2035.

Health Conscious Consumer Trends

The trend towards health consciousness among consumers significantly influences the Global Lactose Free Food Industry. Individuals are increasingly prioritizing their dietary choices, leading to a surge in demand for healthier food options. Lactose-free products are perceived as healthier alternatives, appealing to those seeking to avoid digestive discomfort. This shift is evident in the growing availability of lactose-free dairy products, snacks, and beverages. As a result, the market is expected to grow substantially, with projections indicating a value of 18.7 USD Billion by 2035. This growth reflects a broader trend towards wellness and nutrition-focused consumption.

Growing Vegan and Plant-Based Diets

The rise of veganism and plant-based diets significantly impacts the Global Lactose Free Food Industry. As more consumers adopt these dietary preferences, the demand for lactose-free and dairy alternatives has surged. Plant-based milk, yogurt, and cheese products are increasingly popular, catering to both lactose-intolerant individuals and those seeking to reduce animal product consumption. This trend is reflected in the expanding range of lactose-free options available in supermarkets and specialty stores. The market's growth trajectory is expected to continue, driven by the increasing acceptance of plant-based diets and the projected market value of 18.7 USD Billion by 2035.

Rising Lactose Intolerance Prevalence

The increasing prevalence of lactose intolerance globally drives the Global Lactose Free Food Industry. It is estimated that approximately 68% of the world's population experiences some form of lactose malabsorption. This condition is particularly common in regions such as Asia and Africa, where the majority of adults exhibit reduced lactase enzyme activity. As awareness of lactose intolerance grows, consumers are actively seeking lactose-free alternatives, contributing to the market's expansion. The Global Lactose Free Food Market is projected to reach 7.35 USD Billion in 2024, reflecting the rising demand for products that cater to lactose-sensitive individuals.

Increased Availability of Lactose-Free Products

The increased availability of lactose-free products in retail and online channels significantly influences the Global Lactose Free Food Industry. Retailers are expanding their offerings to include a wider variety of lactose-free options, making it easier for consumers to access these products. This trend is supported by the growing number of specialty stores and online platforms dedicated to health and wellness foods. As consumers become more aware of lactose-free alternatives, the market is likely to see continued growth. The projected market value of 7.35 USD Billion in 2024 underscores the importance of accessibility in driving consumer adoption of lactose-free foods.