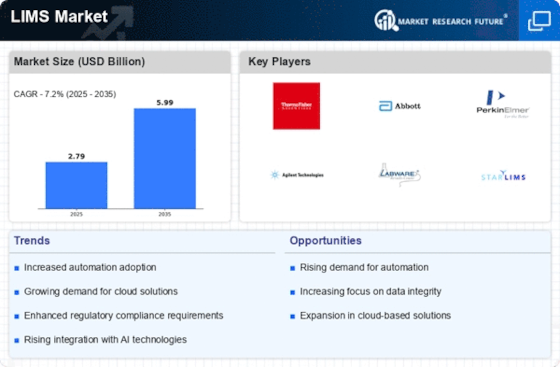

Increased Demand for Automation

The LIMS Market is experiencing a notable surge in demand for automation solutions. Laboratories are increasingly seeking to streamline their operations, reduce human error, and enhance efficiency. Automation in laboratory processes not only accelerates workflows but also ensures consistent data quality. According to recent data, the automation segment within the LIMS Market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend is driven by the need for laboratories to manage increasing sample volumes and complex data sets, thereby necessitating advanced LIMS solutions that can integrate seamlessly with existing laboratory equipment.

Rising Focus on Data Management

The emphasis on effective data management is a prominent driver in the LIMS Market. With the increasing complexity of laboratory data, organizations are prioritizing systems that can manage, store, and analyze data efficiently. LIMS solutions that offer comprehensive data management capabilities are becoming essential for laboratories aiming to enhance their operational workflows. The market for data management within LIMS is anticipated to expand at a rate of 9% as laboratories recognize the importance of data-driven decision-making. This trend is further fueled by the need for real-time data access and reporting, which are critical for maintaining competitive advantage.

Regulatory Compliance Requirements

Regulatory compliance remains a critical driver in the LIMS Market. Laboratories across various sectors, including pharmaceuticals, biotechnology, and environmental testing, are mandated to adhere to stringent regulations. These regulations necessitate robust data management systems that can ensure traceability, data integrity, and audit readiness. As regulatory bodies continue to evolve their standards, the demand for LIMS solutions that facilitate compliance is likely to increase. The LIMS Market is projected to witness a growth rate of around 8% as organizations invest in systems that not only meet current compliance requirements but also adapt to future regulatory changes.

Growing Adoption of Cloud-Based LIMS

The shift towards cloud-based LIMS solutions is transforming the LIMS Market. Organizations are increasingly adopting cloud technologies to benefit from scalability, flexibility, and cost-effectiveness. Cloud-based LIMS systems allow laboratories to access data remotely, facilitating collaboration and enhancing operational efficiency. The market for cloud-based LIMS is projected to grow at a remarkable rate of 15% as more laboratories transition from traditional on-premise systems. This trend is driven by the need for real-time data access and the ability to integrate with other cloud-based applications, thereby streamlining laboratory operations and improving overall productivity.

Integration with Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is significantly influencing the LIMS Market. These technologies enable laboratories to analyze vast amounts of data more effectively, leading to improved decision-making and operational efficiency. The incorporation of AI-driven analytics within LIMS solutions allows for predictive modeling and enhanced data interpretation. As laboratories strive to leverage data for competitive advantage, the demand for LIMS systems that offer such integrations is expected to rise. Market forecasts suggest that the segment focusing on advanced technology integration could grow by approximately 12% in the coming years.