Integration of Advanced Analytical Tools

The integration of advanced analytical tools is significantly shaping the Laboratory Informatics Market. Laboratories are increasingly adopting sophisticated analytical techniques to derive insights from complex datasets. This trend is driven by the need for enhanced accuracy and efficiency in research and development processes. The market for analytical tools, including data visualization and statistical analysis software, is anticipated to expand by approximately 15% in the coming years. Such tools enable laboratories to make informed decisions based on real-time data analysis, thereby improving research outcomes. As a result, vendors in the Laboratory Informatics Market are focusing on creating solutions that seamlessly integrate these advanced analytical capabilities, allowing laboratories to harness the full potential of their data.

Regulatory Compliance and Quality Assurance

Regulatory compliance remains a pivotal driver in the Laboratory Informatics Market. Laboratories are subject to stringent regulations that govern their operations, particularly in sectors such as pharmaceuticals and biotechnology. The need to adhere to these regulations necessitates the implementation of informatics solutions that ensure data accuracy, traceability, and security. As regulatory bodies continue to evolve their standards, laboratories are compelled to invest in informatics systems that facilitate compliance. This has resulted in a projected increase in the market for compliance-driven laboratory informatics solutions, which is expected to grow by around 10% annually. Consequently, the Laboratory Informatics Market is witnessing a shift towards solutions that not only streamline operations but also enhance quality assurance processes.

Rising Demand for Data Management Solutions

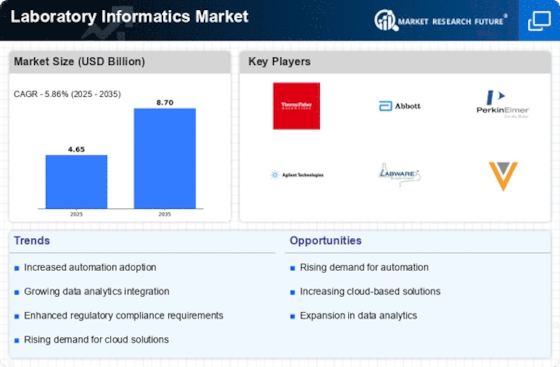

The Laboratory Informatics Market is experiencing a notable surge in demand for advanced data management solutions. Laboratories are increasingly tasked with handling vast amounts of data generated from various experiments and analyses. This has led to a growing need for software that can efficiently manage, store, and analyze this data. According to recent estimates, the data management segment is projected to grow at a compound annual growth rate of approximately 12% over the next five years. This trend indicates that laboratories are prioritizing data integrity and accessibility, which are critical for compliance and operational efficiency. As a result, vendors in the Laboratory Informatics Market are focusing on developing robust data management tools that cater to the specific needs of laboratories, thereby enhancing their overall productivity.

Increased Investment in Research and Development

Investment in research and development is a critical driver of growth in the Laboratory Informatics Market. As organizations strive to innovate and develop new products, the demand for informatics solutions that support R&D activities is on the rise. This trend is particularly evident in sectors such as pharmaceuticals, where the need for efficient data management and analysis is paramount. Recent data suggests that R&D spending in these sectors is expected to increase by approximately 8% annually. This growing investment is likely to propel the demand for laboratory informatics solutions that enhance research capabilities and streamline workflows. Consequently, the Laboratory Informatics Market is witnessing a surge in the development of specialized informatics tools tailored to meet the unique needs of R&D environments.

Growing Emphasis on Collaboration and Connectivity

Collaboration and connectivity are becoming increasingly vital in the Laboratory Informatics Market. As laboratories often operate in multidisciplinary environments, the need for seamless communication and data sharing among teams is paramount. This has led to the development of informatics solutions that facilitate collaborative workflows and enhance connectivity between different laboratory systems. The market for collaborative laboratory informatics solutions is projected to grow at a rate of around 11% over the next few years. By fostering collaboration, laboratories can improve efficiency and innovation, ultimately leading to better research outcomes. Consequently, vendors are prioritizing the development of platforms that support collaborative features, thereby addressing the evolving needs of the Laboratory Informatics Market.