Expansion of Educational Institutions

The expansion of educational institutions, particularly in the fields of science and technology, is a key driver for the Laboratory Furniture Market. As universities and colleges enhance their laboratory facilities to provide students with hands-on experience, the demand for modern and functional laboratory furniture is expected to increase. Recent statistics indicate that enrollment in STEM (Science, Technology, Engineering, and Mathematics) programs has been on the rise, prompting educational institutions to invest in state-of-the-art laboratory environments. This trend not only supports academic growth but also fosters innovation, thereby creating a favorable landscape for the Laboratory Furniture Market. The need for adaptable and versatile furniture solutions that can accommodate various teaching methodologies is likely to shape future market dynamics.

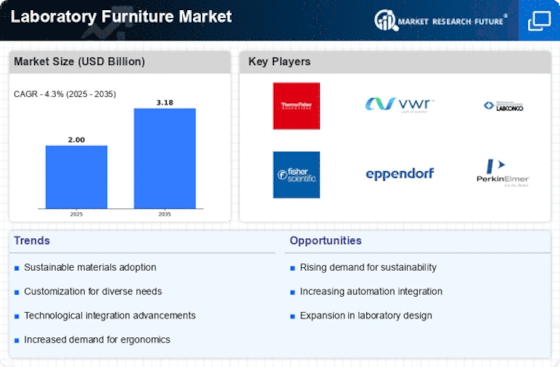

Growing Demand for Sustainable Solutions

The growing demand for sustainable solutions is a prominent driver in the Laboratory Furniture Market. As environmental concerns gain traction, laboratories are increasingly seeking furniture made from eco-friendly materials and designed for longevity. This shift towards sustainability is not only a response to regulatory pressures but also reflects a broader commitment to corporate social responsibility. Manufacturers are now focusing on producing laboratory furniture that minimizes environmental impact while maintaining high performance standards. The trend towards sustainability is expected to influence purchasing decisions, with laboratories prioritizing furniture that aligns with their environmental goals. This evolving landscape presents opportunities for innovation within the Laboratory Furniture Market, as companies strive to meet the needs of environmentally conscious consumers.

Regulatory Compliance and Safety Standards

The Laboratory Furniture Market is significantly influenced by stringent regulatory compliance and safety standards imposed by various governing bodies. Laboratories are required to adhere to specific guidelines regarding the design and materials used in laboratory furniture to ensure safety and functionality. This has led to an increased demand for furniture that meets these regulations, such as chemical resistance and fire safety standards. As laboratories strive to maintain compliance, they are likely to invest in high-quality, durable furniture that aligns with safety protocols. The emphasis on safety not only protects laboratory personnel but also enhances the overall operational efficiency of research facilities, thereby driving growth in the Laboratory Furniture Market.

Increased Research and Development Activities

The Laboratory Furniture Market is experiencing a surge in research and development activities across various sectors, including pharmaceuticals, biotechnology, and academic institutions. This trend is driven by the need for innovative solutions and advanced technologies to enhance laboratory efficiency and safety. As organizations invest in R&D, the demand for specialized laboratory furniture that accommodates new equipment and workflows is likely to rise. According to recent data, the R&D expenditure in the pharmaceutical sector alone has reached unprecedented levels, indicating a robust growth trajectory for the Laboratory Furniture Market. This increase in funding is expected to translate into higher demand for customized laboratory furniture solutions that meet the evolving needs of researchers.

Technological Advancements in Laboratory Equipment

Technological advancements in laboratory equipment are reshaping the Laboratory Furniture Market by necessitating the integration of specialized furniture solutions. As laboratories adopt cutting-edge technologies, such as automation and digitalization, the need for furniture that can support these innovations becomes paramount. For instance, the rise of automated laboratory systems requires furniture that can accommodate complex setups and provide adequate space for equipment. This shift towards high-tech laboratories is expected to drive demand for customizable and modular furniture solutions that can adapt to changing technological landscapes. The Laboratory Furniture Market is likely to benefit from this trend as manufacturers innovate to create furniture that meets the specific requirements of modern laboratories.