Rising Demand for High-Throughput Screening

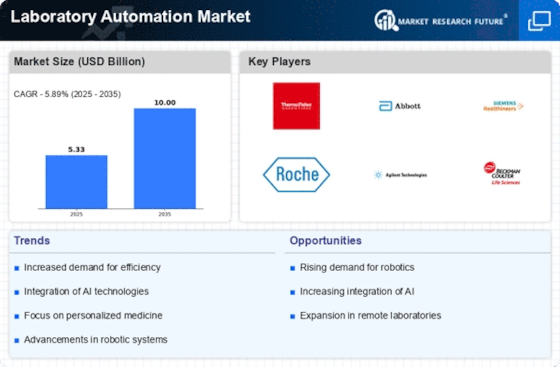

The Laboratory Automation Market is experiencing a notable increase in demand for high-throughput screening technologies. This surge is primarily driven by the need for rapid and efficient testing in drug discovery and development processes. As pharmaceutical companies strive to accelerate their research timelines, the adoption of automated systems that can handle large volumes of samples is becoming essential. Reports indicate that the market for high-throughput screening is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend underscores the critical role that automation plays in enhancing productivity and reducing time-to-market for new therapeutics, thereby shaping the future landscape of the Laboratory Automation Market.

Increasing Regulatory Compliance Requirements

The Laboratory Automation Market is significantly influenced by the increasing regulatory compliance requirements across various sectors, including pharmaceuticals, biotechnology, and clinical laboratories. Regulatory bodies are imposing stringent guidelines to ensure the accuracy and reliability of laboratory results, which necessitates the adoption of automated systems that can provide consistent and reproducible outcomes. Automation technologies facilitate compliance by minimizing human error and enhancing data integrity through advanced tracking and documentation capabilities. As laboratories strive to meet these regulatory standards, the demand for automated solutions is expected to rise. This trend not only supports compliance efforts but also positions laboratories to operate more efficiently within the constraints of regulatory frameworks, thereby fostering growth in the Laboratory Automation Market.

Expansion of Personalized Medicine Initiatives

The Laboratory Automation Market is witnessing a notable expansion driven by the rise of personalized medicine initiatives. As healthcare shifts towards more tailored treatment approaches, laboratories are required to conduct a greater number of tests to identify specific patient needs. This trend necessitates the implementation of automated systems that can efficiently process and analyze diverse biological samples. The increasing prevalence of chronic diseases and the demand for targeted therapies are propelling laboratories to adopt automation technologies that enhance throughput and accuracy. Furthermore, the market is expected to see a rise in partnerships between technology providers and healthcare institutions to develop customized automation solutions that cater to the unique requirements of personalized medicine. This alignment is likely to foster innovation and growth within the Laboratory Automation Market.

Growing Focus on Data Management and Analytics

In the Laboratory Automation Market, there is a growing emphasis on data management and analytics as laboratories seek to harness the power of data for informed decision-making. The integration of automation with data analytics tools allows laboratories to collect, analyze, and interpret vast amounts of data generated during experiments. This capability is particularly crucial in research and development settings, where insights derived from data can lead to breakthroughs in scientific understanding and innovation. Moreover, the ability to visualize and manage data effectively enhances collaboration among research teams and accelerates the pace of discovery. As laboratories increasingly recognize the value of data-driven approaches, the demand for automated systems that incorporate advanced analytics is likely to expand, further propelling the Laboratory Automation Market.

Advancements in Robotics and Automation Technologies

Technological advancements in robotics and automation are transforming the Laboratory Automation Market. Innovations in robotic systems, such as improved precision and flexibility, are enabling laboratories to automate complex tasks that were previously labor-intensive. The integration of sophisticated robotic arms and automated liquid handling systems is streamlining workflows, thereby enhancing efficiency and accuracy in laboratory processes. Furthermore, the market is witnessing a shift towards modular automation solutions that allow for easy scalability and customization. This adaptability is particularly appealing to laboratories of varying sizes, as it enables them to optimize their operations without significant upfront investments. As these technologies continue to evolve, they are likely to drive further growth in the Laboratory Automation Market.