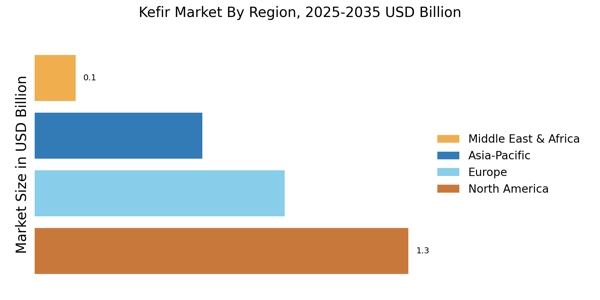

The Global Kefir Market is currently experiencing a notable transformation, driven by increasing consumer awareness regarding health and wellness. This shift is reflected in the rising demand for probiotic-rich foods, as individuals seek to enhance their digestive health and overall well-being. Kefir, with its unique fermentation process, offers a diverse range of beneficial bacteria and yeasts, which are believed to support gut health. As a result, various brands are innovating their product lines to cater to this growing interest, introducing flavored options and convenient packaging to attract a broader audience. Furthermore, the trend towards natural and organic products is influencing consumer preferences, leading to a surge in demand for organic kefir variants. In addition to health benefits, the Kefir Market is also witnessing a surge in popularity due to the increasing trend of plant-based diets. As more consumers adopt vegetarian and vegan lifestyles, dairy alternatives are becoming essential. This has prompted manufacturers to explore non-dairy kefir options, utilizing ingredients such as coconut, almond, and soy. The expansion of distribution channels, including online platforms, is further facilitating access to these products, making it easier for consumers to incorporate kefir into their diets. Overall, the Kefir Market appears poised for continued growth, driven by evolving consumer preferences and a heightened focus on health-conscious choices.

Health and Wellness Focus

Kefir benefits probiotics are gaining widespread recognition for supporting gut health, immunity, and digestion, which is driving increasing demand and contributing to the expansion of the kefir market size global. As consumer interest in functional beverages rises, many are exploring how to make kefir at home using simple fermentation methods, further boosting awareness and adoption. Comparisons between dairy vs water kefir highlight differences in taste, lactose content, and probiotic diversity, appealing to both traditional dairy consumers and plant-based lifestyle followers. Looking ahead, kefir drink trends 2026 are expected to focus on low-sugar formulations, flavored and fortified options, and sustainable packaging, positioning kefir as a key growth segment in the global probiotic beverage market.

The Kefir Market trend highlights is increasingly influenced by a growing emphasis on health and wellness. Consumers are actively seeking probiotic-rich foods to improve digestive health, leading to heightened interest in kefir products. Kefir at Fresh Market is highly sought after by health-conscious shoppers who value the retailer’s curated selection of premium, grass-fed, and organic probiotic brands that support gut health.

Rise of Plant-Based Alternatives

Another prominent Kefir market trend is gaining traction of plant-based. the demand for non-dairy kefir options is on the rise. Manufacturers are exploring various plant-based ingredients to cater to this expanding consumer segment.

Innovative Product Offerings

To attract a wider audience, brands are diversifying their product lines with flavored kefir and convenient packaging. This innovation is aimed at enhancing consumer experience and meeting diverse taste preferences.

Demand for Luxury

The home textile market size for luxury items is expanding at twice the rate of the economy segment, as affluent consumers invest in high-thread-count Egyptian cotton and silk blends.