Increasing Health Awareness

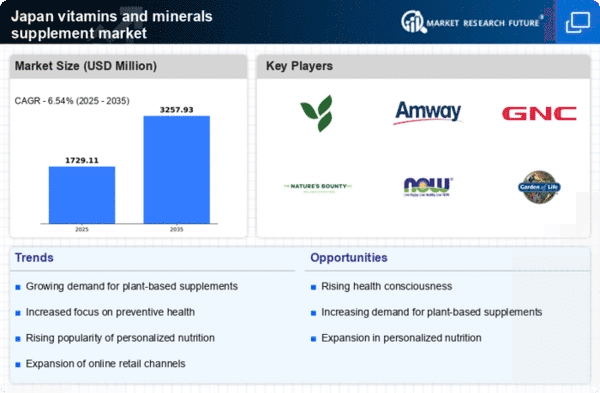

The vitamins minerals-supplement market in Japan is experiencing a notable surge due to rising health consciousness among consumers. Individuals are increasingly prioritizing their well-being, leading to a greater demand for dietary supplements that support overall health. According to recent data, approximately 60% of Japanese adults actively seek out vitamins and minerals to enhance their health. This trend is particularly pronounced among the aging population, who are more inclined to invest in supplements that promote longevity and vitality. As a result, the vitamins minerals-supplement market is projected to grow at a CAGR of 8% over the next five years, reflecting the shift towards preventive health measures and proactive wellness strategies.

Aging Population and Nutritional Needs

Japan's demographic landscape is characterized by a rapidly aging population, which is a critical driver for the vitamins minerals-supplement market. As individuals age, their nutritional requirements evolve, often necessitating higher intakes of specific vitamins and minerals to maintain health. Reports indicate that nearly 30% of seniors in Japan regularly consume dietary supplements to address deficiencies and support their health. This demographic shift is prompting manufacturers to develop targeted products that cater to the unique needs of older adults, thereby expanding the market. The increasing focus on geriatric nutrition is likely to propel the vitamins minerals-supplement market, with projections indicating a growth rate of 7% annually.

Influence of Social Media and Health Trends

Social media platforms are playing a pivotal role in shaping consumer perceptions and behaviors within the vitamins minerals-supplement market in Japan. Influencers and health advocates are increasingly promoting the benefits of various supplements, leading to heightened awareness and interest among consumers. This digital influence is particularly impactful among younger demographics, who are more likely to explore new health trends and products shared online. As a result, the vitamins minerals-supplement market is expected to see a significant uptick in engagement and sales, with estimates suggesting a 12% increase in market penetration driven by social media campaigns and influencer partnerships.

Rising Interest in Holistic Health Approaches

The vitamins minerals-supplement market in Japan is witnessing a growing inclination towards holistic health approaches. Consumers are increasingly recognizing the interconnectedness of physical, mental, and emotional well-being, leading to a demand for supplements that support comprehensive health. This trend is reflected in the rising popularity of products that combine vitamins, minerals, and herbal ingredients, appealing to those seeking natural solutions for health enhancement. Market analysis suggests that this holistic perspective could contribute to a 5% increase in sales within the vitamins minerals-supplement market over the next few years, as consumers gravitate towards products that align with their overall wellness philosophies.

Technological Advancements in Product Development

Innovations in technology are significantly influencing the vitamins minerals-supplement market in Japan. The development of advanced formulations and delivery systems, such as gummies and effervescent tablets, is attracting a broader consumer base. These innovations not only enhance the palatability of supplements but also improve bioavailability, ensuring that nutrients are effectively absorbed by the body. Furthermore, the integration of digital platforms for personalized nutrition is gaining traction, allowing consumers to tailor their supplement intake based on individual health needs. This technological evolution is expected to drive market growth, with an estimated increase of 10% in product offerings over the next few years.