Expansion of 5G Networks

The rollout of 5G networks in Japan is a critical factor influencing the telecom tower-power-system market. With the government and private sector investing heavily in 5G infrastructure, the demand for telecom towers is set to increase significantly. It is estimated that by 2026, Japan will require an additional 30,000 telecom towers to support 5G services. This expansion necessitates advanced power systems capable of handling higher energy loads and ensuring reliability. Consequently, the telecom tower-power-system market is poised for growth as operators seek to establish a robust 5G network across the country.

Increased Focus on Energy Efficiency

The growing emphasis on energy efficiency within the telecom sector is a significant driver for the telecom tower-power-system market. Japanese telecom companies are under pressure to reduce their carbon footprint and operational costs. As a result, many are investing in energy-efficient power systems that can lower energy consumption by up to 40%. This shift not only aligns with global sustainability goals but also enhances the overall performance of telecom networks. The telecom tower-power-system market is thus expected to expand as companies prioritize energy-efficient solutions to meet regulatory standards and consumer expectations.

Rising Demand for Mobile Connectivity

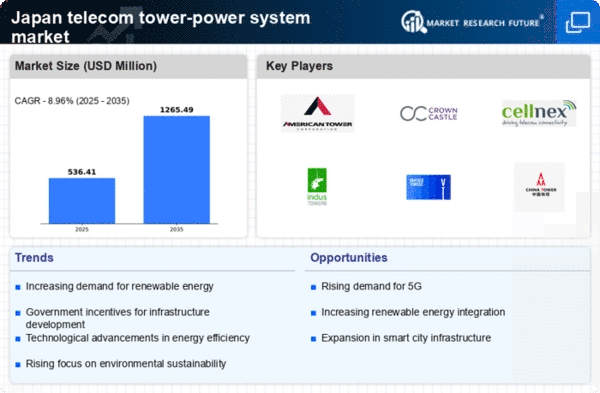

The increasing reliance on mobile connectivity in Japan is a primary driver for the telecom tower-power-system market. With a population that is highly engaged in digital communication, the demand for robust mobile networks continues to surge. As of 2025, mobile data traffic in Japan is projected to grow by approximately 30% annually, necessitating the expansion of telecom infrastructure. This growth compels telecom operators to invest in advanced power systems to ensure uninterrupted service. The telecom tower-power-system market is thus positioned to benefit from this trend, as operators seek to enhance their network capabilities to meet consumer expectations.

Technological Advancements in Power Systems

Technological advancements in power systems are reshaping the telecom tower-power-system market. Innovations such as energy-efficient power supplies and smart grid technologies are becoming increasingly prevalent. These advancements not only reduce operational costs but also enhance the reliability of power systems. In Japan, the adoption of such technologies is expected to increase by 25% over the next five years, driven by the need for sustainable energy solutions. As telecom operators seek to modernize their infrastructure, the demand for advanced power systems will likely rise, further propelling market growth.

Government Initiatives for Infrastructure Development

Japanese government initiatives aimed at enhancing telecommunications infrastructure significantly influence the telecom tower-power-system market. The government has allocated substantial funding, estimated at ¥500 billion, to improve network coverage in rural areas. This initiative is expected to increase the number of telecom towers, thereby driving demand for efficient power systems. Furthermore, the government's commitment to digital transformation aligns with the need for reliable power solutions, as more towers require advanced energy management systems. Consequently, the telecom tower-power-system market is likely to experience growth as these initiatives unfold.