Rising Healthcare Expenditure

Japan's healthcare expenditure continues to rise, which positively influences the surgical sutures market. In 2025, healthcare spending is expected to reach approximately ¥42 trillion, reflecting a commitment to improving healthcare services. This increase in funding allows for the procurement of advanced surgical sutures, which are essential for effective surgical outcomes. The surgical sutures market stands to gain from this trend, as hospitals and clinics prioritize high-quality materials and technologies to enhance patient care. As healthcare budgets expand, the demand for superior suturing solutions is likely to grow, further driving market expansion.

Increasing Surgical Procedures

The surgical sutures market in Japan is experiencing growth due to the rising number of surgical procedures performed annually. Factors such as an aging population and advancements in surgical techniques contribute to this trend. In 2025, it is estimated that the number of surgeries will increase by approximately 5% compared to previous years. This surge in surgical interventions necessitates a corresponding demand for high-quality sutures, as they are critical for effective wound closure and healing. The surgical sutures market is thus poised to benefit from this upward trajectory, as healthcare providers seek reliable and innovative suture solutions to enhance patient outcomes.

Growing Awareness of Surgical Safety

There is a heightened awareness of surgical safety among healthcare providers and patients in Japan, which is influencing the surgical sutures market. As surgical complications can lead to significant health risks, the emphasis on using reliable sutures has intensified. In 2025, it is anticipated that hospitals will increasingly adopt best practices in surgical procedures, including the selection of high-quality sutures. This trend indicates a shift towards prioritizing patient safety and outcomes, thereby benefiting the surgical sutures market. Manufacturers that focus on quality assurance and safety features in their products are likely to see increased demand.

Technological Advancements in Sutures

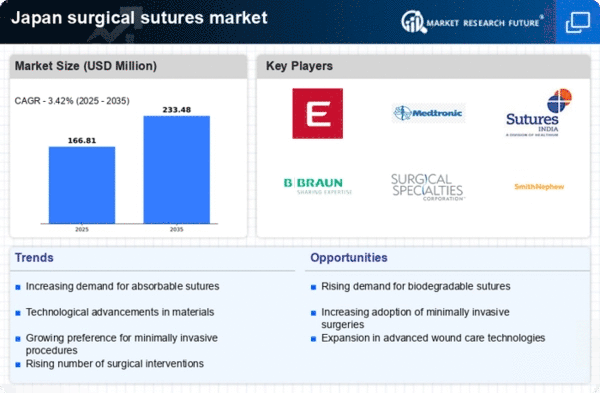

Innovations in suture technology are significantly impacting the surgical sutures market in Japan. The introduction of absorbable sutures and antimicrobial coatings has revolutionized wound management, reducing infection rates and improving healing times. In 2025, the market for advanced sutures is projected to grow by 7%, driven by these technological advancements. The surgical sutures market is adapting to these changes, with manufacturers investing in research and development to create products that meet the evolving needs of healthcare professionals. This focus on innovation is likely to enhance the competitive landscape and provide better options for surgeons.

Expansion of Minimally Invasive Surgeries

The surgical sutures market is also being driven by the expansion of minimally invasive surgical techniques in Japan. These procedures, which often require specialized sutures, are gaining popularity due to their benefits, including reduced recovery times and lower complication rates. In 2025, the market for sutures used in minimally invasive surgeries is projected to grow by 6%. The surgical sutures market must adapt to this trend by developing sutures that cater specifically to the needs of these advanced surgical methods. This adaptation could lead to increased market share for companies that innovate in this area.