Emergence of 5G Technology

The rollout of 5G technology is poised to significantly impact the software defined-networking market in Japan. With its promise of ultra-fast connectivity and low latency, 5G is expected to drive demand for more sophisticated networking solutions. The software defined-networking market is likely to benefit from the need to manage the increased complexity and scale associated with 5G networks. As businesses and service providers prepare for the 5G era, there is a growing recognition of the importance of software defined networking in facilitating seamless integration and management of diverse network elements. Analysts predict that the software defined-networking market could see a growth rate of around 20% as 5G adoption accelerates. This trend underscores the critical role that software defined networking will play in enabling the next generation of connectivity and digital services.

Increased Focus on Data Privacy

As data privacy concerns continue to escalate, the software defined-networking market in Japan is witnessing a heightened focus on security measures. Organizations are compelled to adopt solutions that not only enhance network performance but also ensure the protection of sensitive information. The implementation of software defined networking allows for more granular control over data flows and access policies, thereby addressing compliance requirements and mitigating risks. Recent surveys indicate that approximately 70% of enterprises in Japan prioritize data security when selecting networking solutions. This trend is driving vendors to integrate advanced security features into their software defined-networking offerings, making them more attractive to potential customers. As a result, the software defined-networking market is likely to expand as organizations seek to balance performance with robust security protocols.

Growing Need for Cost Efficiency

Cost efficiency remains a critical driver in the software defined-networking market in Japan. Organizations are increasingly recognizing the financial benefits associated with adopting software defined networking solutions. By virtualizing network resources, companies can reduce hardware expenditures and operational costs. Recent studies indicate that businesses can achieve savings of up to 30% by transitioning to software defined networking architectures. This financial incentive is compelling many enterprises to explore software defined-networking solutions as a means to optimize their IT budgets. Additionally, the ability to automate network management processes further contributes to cost reductions, allowing IT teams to focus on strategic initiatives rather than routine maintenance. Consequently, the software defined-networking market is poised for growth as more organizations seek to enhance their cost efficiency through innovative networking solutions.

Rising Demand for Network Agility

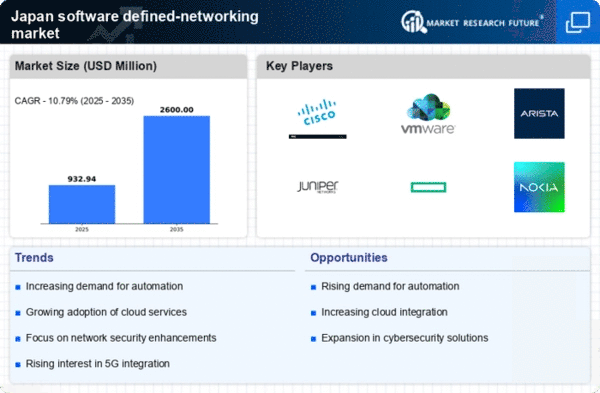

The software defined-networking market in Japan is experiencing a notable surge in demand for enhanced network agility. Organizations are increasingly seeking solutions that allow for rapid deployment and reconfiguration of network resources. This shift is driven by the need for businesses to adapt quickly to changing market conditions and customer demands. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of a broader trend where enterprises prioritize flexibility and responsiveness in their IT infrastructure. As a result, vendors in the software defined-networking market are innovating to provide solutions that facilitate seamless integration and management of diverse network environments, thereby enhancing overall operational efficiency.

Government Initiatives and Support

The Japanese government is actively promoting the adoption of advanced networking technologies, including software defined-networking. Initiatives aimed at fostering innovation and digital transformation are creating a conducive environment for market growth. For instance, the government has allocated substantial funding to support research and development in networking technologies. This support is expected to bolster the software defined-networking market, as companies leverage these resources to enhance their offerings. Furthermore, regulatory frameworks are being established to encourage the deployment of next-generation networking solutions. As a result, the software defined-networking market is likely to benefit from increased investment and collaboration between public and private sectors, driving further advancements in technology and infrastructure.