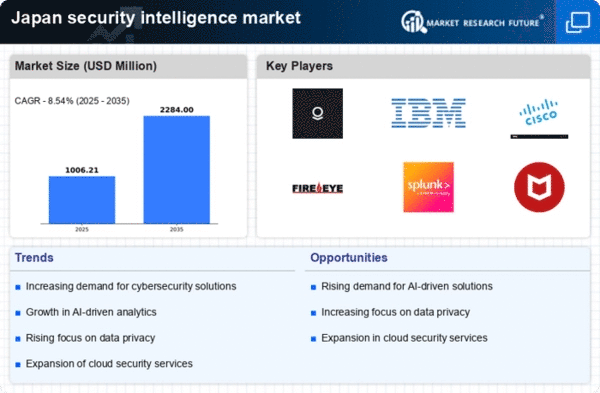

Growing Cyber Threat Landscape

The security intelligence market in Japan is experiencing a surge due to the escalating cyber threat landscape. With cyberattacks becoming increasingly sophisticated, organizations are compelled to invest in advanced security solutions. Reports indicate that cybercrime costs in Japan could reach ¥1 trillion by 2025, highlighting the urgent need for robust security measures. This environment fosters a demand for security intelligence solutions that can proactively identify and mitigate threats. As businesses recognize the potential financial and reputational damage from breaches, the focus on security intelligence market offerings intensifies. Consequently, companies are prioritizing investments in threat detection and response capabilities, driving growth in the security intelligence market.

Rising Awareness of Data Privacy

In Japan, the rising awareness of data privacy among consumers and businesses is significantly impacting the security intelligence market. As individuals become more conscious of their personal data rights, organizations are compelled to adopt stringent security measures to protect sensitive information. This shift is evident in the growing demand for security intelligence solutions that offer comprehensive data protection capabilities. A recent study suggests that 80% of consumers are concerned about data breaches, prompting businesses to prioritize security investments. Consequently, the security intelligence market is likely to expand as organizations seek to enhance their data privacy practices and build consumer trust through robust security frameworks.

Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors in Japan are driving the security intelligence market. As organizations migrate to digital platforms, the attack surface expands, necessitating advanced security measures. A recent survey indicates that 70% of Japanese companies are prioritizing digital transformation, which inherently increases their vulnerability to cyber threats. This shift compels businesses to invest in security intelligence solutions that provide real-time insights and threat intelligence. The integration of security into digital transformation strategies is becoming essential, as organizations aim to protect sensitive data and maintain operational continuity. Thus, the security intelligence market is poised for growth as companies seek to secure their digital assets.

Regulatory Pressures and Compliance

In Japan, the security intelligence market is significantly influenced by regulatory pressures and compliance requirements. The introduction of stringent data protection laws, such as the Act on the Protection of Personal Information, mandates organizations to enhance their security frameworks. Non-compliance can result in hefty fines, which may reach up to ¥100 million. As a result, businesses are increasingly adopting security intelligence solutions to ensure adherence to these regulations. This trend not only mitigates legal risks but also enhances customer trust. The growing emphasis on compliance is likely to propel the security intelligence market, as organizations seek to implement comprehensive security strategies that align with regulatory standards.

Increased Investment in Security Technologies

The security intelligence market in Japan is witnessing increased investment in security technologies, driven by the recognition of cybersecurity as a critical business priority. Organizations are allocating larger budgets to enhance their security postures, with spending on security solutions projected to grow by 15% annually. This trend reflects a broader understanding that effective security intelligence is vital for safeguarding assets and ensuring business resilience. Companies are increasingly adopting advanced technologies, such as threat intelligence platforms and security information and event management (SIEM) systems, to bolster their defenses. As the market evolves, the focus on innovative security technologies is likely to shape the future landscape of the security intelligence market.