Increased Urbanization

The rapid urbanization in Japan is driving the demand for recycling equipment market. As cities expand, the volume of waste generated increases significantly, necessitating efficient waste management solutions. Urban areas are projected to account for over 90% of the total waste generated in the country. This trend compels municipalities and private sectors to invest in advanced recycling technologies to manage waste effectively. The recycling equipment market is likely to benefit from this urban growth, as local governments seek to enhance their recycling rates, which currently hover around 20%. The need for innovative recycling solutions is becoming increasingly apparent, as urban centers strive to meet sustainability goals and reduce landfill dependency.

Rising Environmental Awareness

There is a growing environmental consciousness among the Japanese populace, which is influencing the recycling equipment market. Citizens are increasingly aware of the environmental impacts of waste and are advocating for better recycling practices. This heightened awareness is prompting both consumers and businesses to seek out more efficient recycling solutions. Surveys indicate that over 70% of Japanese citizens support stricter recycling regulations, which could lead to increased demand for advanced recycling equipment. As public pressure mounts for improved waste management practices, the recycling equipment market is expected to expand, driven by the need for innovative technologies that align with consumer values.

Government Initiatives and Funding

The Japanese government has been actively promoting recycling initiatives, which is positively impacting the recycling equipment market. Various programs and funding opportunities are available to support the development and implementation of recycling technologies. For instance, the government has allocated approximately ¥100 billion to enhance recycling infrastructure and promote the adoption of advanced recycling equipment. This financial backing encourages businesses to invest in modern recycling solutions, thereby increasing the overall efficiency of waste management systems. Furthermore, government policies aimed at reducing waste generation and promoting circular economy principles are likely to create a favorable environment for the recycling equipment market.

Technological Innovations in Recycling

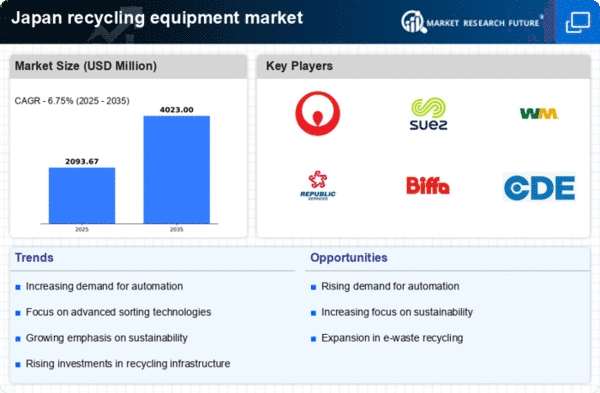

Technological advancements are playing a crucial role in shaping the recycling equipment market. Innovations such as automated sorting systems, AI-driven waste management solutions, and advanced shredding technologies are enhancing the efficiency of recycling processes. These technologies not only improve the quality of recycled materials but also reduce operational costs for recycling facilities. The market for recycling equipment is projected to grow by approximately 15% annually, driven by these technological innovations. As companies in Japan adopt these cutting-edge solutions, the recycling equipment market is likely to experience significant growth, reflecting the increasing demand for efficient waste processing technologies.

Corporate Social Responsibility Initiatives

Many companies in Japan are increasingly adopting corporate social responsibility (CSR) initiatives that emphasize sustainability and waste reduction. This trend is positively influencing the recycling equipment market, as businesses seek to enhance their environmental credentials. Companies are investing in recycling technologies to improve their waste management practices and meet consumer expectations for sustainable operations. Research indicates that over 60% of Japanese firms are prioritizing sustainability in their business strategies, which is likely to drive demand for advanced recycling equipment. As organizations strive to align their operations with CSR goals, the recycling equipment market is expected to benefit from this shift towards more responsible waste management practices.