Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure are significantly impacting the rapid diagnostics market. In Japan, the government has been actively investing in healthcare technologies to enhance disease detection and management. Recent policies have allocated substantial funding to support the development of rapid diagnostic tools, which are essential for timely medical interventions. The rapid diagnostics market is likely to benefit from these initiatives, as they promote innovation and accessibility to advanced diagnostic solutions. For instance, the Ministry of Health, Labour and Welfare has set a target to increase the availability of rapid testing kits in healthcare facilities by 30% over the next five years. This commitment underscores the government's role in fostering a conducive environment for market growth.

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases in Japan is a crucial driver for the rapid diagnostics market. As the population ages, conditions such as diabetes, cardiovascular diseases, and respiratory disorders become more common. This trend necessitates timely and accurate diagnostic solutions to manage these health issues effectively. The rapid diagnostics market is likely to see a surge in demand for tests that can provide quick results, enabling healthcare providers to make informed decisions. According to recent estimates, chronic diseases account for approximately 60% of all deaths in Japan, highlighting the urgent need for efficient diagnostic tools. Consequently, the market is expected to grow as healthcare systems adapt to these challenges, focusing on early detection and management of chronic conditions.

Aging Population and Healthcare Demand

Japan's aging population is a pivotal driver for the rapid diagnostics market. With a significant portion of the population over the age of 65, there is an increasing demand for healthcare services, including diagnostic testing. The rapid diagnostics market is responding to this demographic shift by developing tests that cater specifically to age-related health issues. As older adults often require more frequent health assessments, the need for rapid and reliable diagnostic tools is becoming more pronounced. Projections suggest that the market could expand by approximately 20% over the next five years, driven by the necessity for efficient healthcare solutions tailored to the elderly. This demographic trend underscores the importance of rapid diagnostics in managing the health of Japan's aging population.

Technological Integration in Healthcare

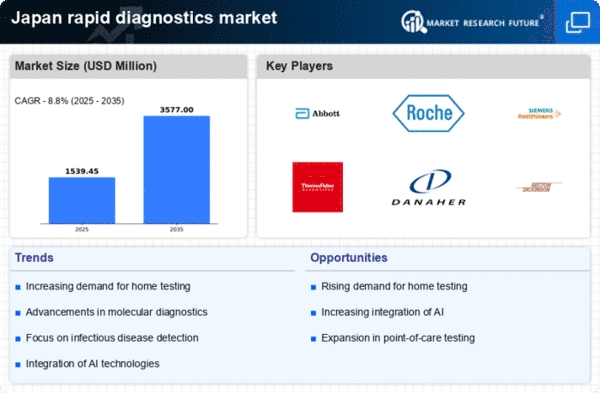

The integration of advanced technologies in healthcare is transforming the rapid diagnostics market. Innovations such as artificial intelligence, machine learning, and point-of-care testing devices are enhancing the accuracy and speed of diagnostic processes. In Japan, the adoption of these technologies is becoming increasingly prevalent, as healthcare providers seek to improve patient outcomes and streamline operations. The rapid diagnostics market is experiencing a shift towards more sophisticated testing methods, which can deliver results in real-time. This technological evolution is projected to drive market growth, with investments in research and development expected to reach approximately ¥100 billion by 2026. As a result, the landscape of diagnostics is evolving, making it essential for stakeholders to stay abreast of these advancements.

Consumer Awareness and Health Consciousness

There is a growing trend of health consciousness among consumers in Japan, which is driving the rapid diagnostics market. As individuals become more aware of their health and the importance of early detection, the demand for rapid diagnostic tests is increasing. This shift in consumer behavior is prompting healthcare providers to offer more accessible testing options. The rapid diagnostics market is witnessing a rise in home testing kits and point-of-care solutions, catering to the needs of health-conscious individuals. Market Research Future indicates that approximately 45% of Japanese consumers are now willing to invest in at-home diagnostic tests, reflecting a significant change in attitudes towards personal health management. This trend is expected to continue, further propelling the market forward.