Emergence of 5G Technology

The rollout of 5G technology in Japan is significantly impacting the photonic integrated-circuit market. As 5G networks require enhanced data processing capabilities and lower latency, photonic integrated circuits are becoming increasingly vital. The market for 5G infrastructure is projected to exceed $20 billion by 2025, with a substantial portion allocated to photonic technologies. These circuits facilitate the efficient handling of vast amounts of data, which is crucial for the performance of 5G applications. Consequently, the demand for photonic integrated circuits is expected to surge, as they play a pivotal role in enabling the high-speed connectivity that 5G promises.

Growth in Consumer Electronics

The growth in consumer electronics in Japan is a notable driver for the photonic integrated-circuit market. With the rising popularity of smart devices, including smartphones, tablets, and wearables, there is an increasing need for advanced optical components. The consumer electronics market is anticipated to reach $50 billion by 2025, with a significant portion of this growth attributed to innovations in photonic technologies. Photonic integrated circuits are essential for enhancing the performance and energy efficiency of these devices, thereby driving their adoption. This trend suggests a robust future for the photonic integrated-circuit market as it aligns with consumer demands for faster and more efficient electronic products.

Rising Demand for Data Centers

The rising demand for data centers in Japan is significantly influencing the photonic integrated-circuit market. As businesses increasingly rely on cloud computing and big data analytics, the need for efficient data processing and storage solutions has surged. The data center market is projected to grow to $10 billion by 2026, with a focus on integrating photonic technologies to improve performance and reduce energy consumption. Photonic integrated circuits are essential for optimizing data transfer speeds and minimizing latency, making them a crucial component in modern data center architectures. This trend indicates a promising outlook for the photonic integrated-circuit market as it aligns with the evolving needs of the digital economy.

Investment in Research and Development

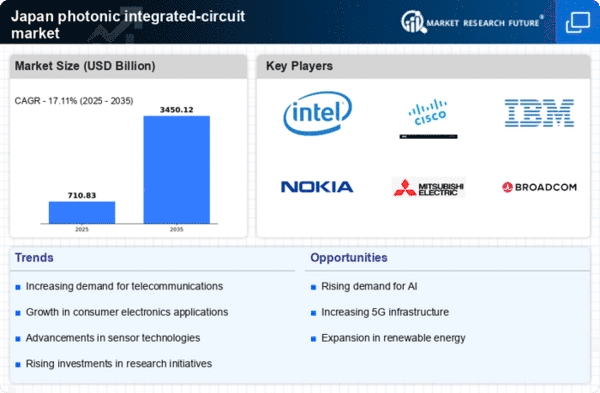

Investment in research and development (R&D) within Japan's photonic integrated-circuit market is a critical driver. The government and private sector are increasingly allocating funds to explore new applications and improve existing technologies. In 2025, R&D spending in the photonics sector is projected to reach $1.5 billion, focusing on innovations that enhance the capabilities of photonic integrated circuits. This investment is likely to lead to breakthroughs in areas such as quantum computing and advanced sensing technologies, which could further expand the market. As R&D efforts continue to yield new solutions, the photonic integrated-circuit market is expected to benefit from enhanced product offerings and increased competitiveness.

Advancements in Telecommunications Infrastructure

Ongoing advancements in telecommunications infrastructure in Japan are driving the photonic integrated-circuit market. With the increasing demand for high-speed internet and data services, telecommunications companies are investing heavily in upgrading their networks. This investment is expected to reach approximately $10 billion by 2026, focusing on fiber-optic technologies that utilize photonic integrated circuits. These circuits enable faster data transmission and improved bandwidth, which are essential for supporting the growing number of connected devices. As a result, the photonic integrated-circuit market is likely to experience substantial growth, as these components are integral to the development of next-generation communication systems.