Rising Adoption of IoT Devices

The increasing adoption of Internet of Things (IoT) devices in India is driving demand for the photonic integrated-circuit market. As industries such as agriculture, healthcare, and smart cities embrace IoT technologies, the need for efficient data transmission and processing becomes paramount. Photonic integrated circuits are well-suited for IoT applications due to their ability to handle large volumes of data with minimal energy consumption. The IoT market in India is projected to grow at a CAGR of around 30% by 2025, indicating a robust demand for photonic solutions. This trend suggests that manufacturers of photonic integrated circuits may find lucrative opportunities in developing specialized products tailored for IoT applications.

Surge in Data Center Establishments

The rapid establishment of data centers across India is significantly influencing the photonic integrated-circuit market. As businesses increasingly rely on cloud computing and big data analytics, the demand for efficient data processing and storage solutions is escalating. Photonic integrated circuits offer superior performance in terms of speed and energy efficiency, making them ideal for data center applications. Reports indicate that the data center market in India is expected to reach $4 billion by 2025, driven by the need for enhanced data management capabilities. This growth is likely to create substantial opportunities for photonic integrated-circuit manufacturers, as these components are crucial for optimizing data transfer rates and minimizing energy consumption in data centers.

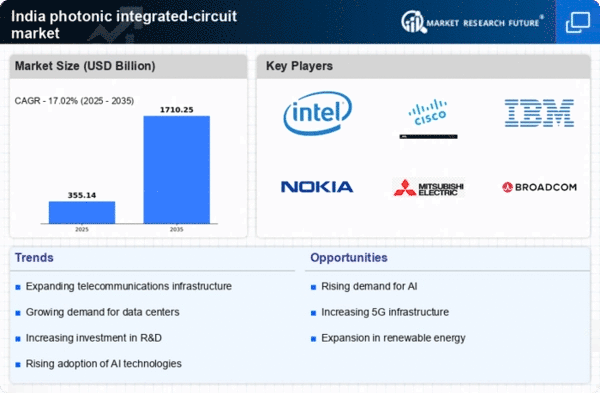

Growing Telecommunications Infrastructure

The expansion of telecommunications infrastructure in India is a pivotal driver for the photonic integrated-circuit market. With the increasing demand for high-speed internet and mobile connectivity, investments in fiber optic networks are surging. The Indian government has initiated various projects to enhance digital connectivity, aiming to connect rural and urban areas alike. This infrastructure development is expected to propel the adoption of photonic integrated circuits, which are essential for efficient data transmission. As of 2025, the Indian telecommunications sector is projected to grow at a CAGR of approximately 15%, further stimulating the photonic integrated-circuit market. The integration of these circuits into communication systems will likely enhance bandwidth and reduce latency, making them indispensable for future telecommunications advancements.

Focus on Advanced Research and Development

The emphasis on advanced research and development in photonics is a crucial driver for the photonic integrated-circuit market. Indian research institutions and universities are increasingly focusing on photonic technologies, fostering innovation and collaboration with industry players. This focus is likely to lead to breakthroughs in photonic integrated circuit designs and applications, enhancing their performance and functionality. Government funding for research initiatives in photonics is expected to increase, potentially exceeding $500 million by 2025. Such investments could accelerate the development of next-generation photonic integrated circuits, positioning India as a hub for photonic innovation and contributing to the overall growth of the market.

Government Initiatives for Semiconductor Manufacturing

The Indian government's initiatives to bolster semiconductor manufacturing are poised to have a profound impact on the photonic integrated-circuit market. With the aim of reducing dependency on imports and fostering local production, the government has introduced various incentives and policies. The semiconductor policy is expected to attract investments exceeding $10 billion by 2025, which could enhance the domestic production of photonic integrated circuits. This strategic move not only aims to create a self-sufficient semiconductor ecosystem but also positions India as a competitive player in the global market. As local manufacturing capabilities expand, the photonic integrated-circuit market is likely to benefit from reduced costs and improved supply chain efficiencies.