Rising Healthcare Expenditure

Japan's healthcare expenditure has been on the rise, which positively influences the overactive bladder-treatment market. The government has been increasing its budget allocation for healthcare services, with spending reaching approximately 10% of GDP. This financial commitment allows for better access to innovative treatments and medications for OAB. Furthermore, as healthcare costs are covered under the national health insurance system, patients are more likely to seek treatment for OAB symptoms. This trend suggests that the overactive bladder-treatment market will benefit from increased patient engagement and a willingness to invest in effective therapies, ultimately leading to improved health outcomes.

Growing Focus on Quality of Life

There is a growing recognition of the importance of quality of life among patients suffering from overactive bladder in Japan. Healthcare professionals and policymakers are increasingly aware that OAB can severely affect daily activities, mental health, and social interactions. This awareness has led to a shift in treatment paradigms, emphasizing the need for effective management strategies. As a result, the overactive bladder-treatment market is likely to see a surge in demand for therapies that not only alleviate symptoms but also enhance overall well-being. This focus on quality of life may drive the development of new treatment options and patient-centered care models.

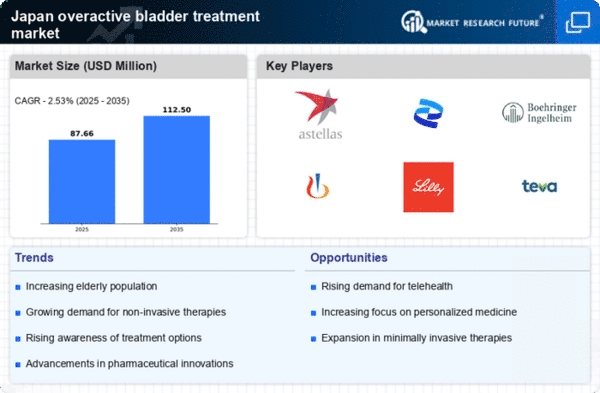

Aging Population and Increased Incidence

The aging population in Japan is a critical driver for the overactive bladder-treatment market. As individuals age, the prevalence of overactive bladder (OAB) symptoms tends to increase, leading to a higher demand for effective treatments. According to recent statistics, approximately 16% of the elderly population in Japan experiences OAB symptoms, which significantly impacts their quality of life. This demographic shift is expected to continue, with projections indicating that by 2030, over 30% of the population will be aged 65 and older. Consequently, the overactive bladder-treatment market is likely to expand as healthcare providers seek to address the needs of this growing segment, leading to increased investments in research and development of new therapies.

Increased Research and Development Activities

The overactive bladder-treatment market is experiencing a boost due to increased research and development activities in Japan. Pharmaceutical companies and research institutions are investing significantly in the discovery of novel therapies and treatment modalities for OAB. Recent data indicates that R&D spending in the pharmaceutical sector has grown by approximately 5% annually, reflecting a commitment to addressing unmet medical needs. This trend suggests that the market will likely see the introduction of innovative products, including new drug formulations and advanced delivery systems, which could enhance treatment efficacy and patient adherence.

Enhanced Patient Education and Support Programs

Enhanced patient education and support programs are emerging as a vital driver for the overactive bladder-treatment market. In Japan, healthcare providers are increasingly implementing initiatives aimed at educating patients about OAB symptoms, treatment options, and lifestyle modifications. These programs are designed to empower patients, enabling them to make informed decisions regarding their health. As awareness grows, more individuals are likely to seek treatment for OAB, thereby expanding the market. Furthermore, these educational efforts may lead to improved treatment adherence and better health outcomes, ultimately benefiting the overall healthcare system.