Government Initiatives and Funding

The Japanese government is actively promoting the medical robotics market through various initiatives and funding programs. By allocating substantial resources to research and development, the government aims to position Japan as a leader in medical technology innovation. Recent policies have included financial incentives for hospitals to adopt robotic systems, which could potentially increase market penetration by 25% over the next few years. Additionally, collaborations between public and private sectors are fostering innovation in robotic technologies. These efforts are likely to enhance the overall landscape of the medical robotics market, encouraging further advancements and adoption across healthcare facilities.

Aging Population and Healthcare Demand

Japan's demographic shift towards an aging population is significantly impacting the medical robotics market. With over 28% of the population aged 65 and older, there is an escalating demand for healthcare services, particularly in surgical and rehabilitation sectors. This demographic trend necessitates the adoption of robotic systems to manage the increasing volume of surgeries and rehabilitation procedures. The medical robotics market is projected to grow by 20% in the next five years. This growth is driven by the need for efficient and effective healthcare solutions tailored to the elderly. Consequently, healthcare providers are prioritizing investments in robotic technologies to meet this rising demand.

Technological Advancements in Robotics

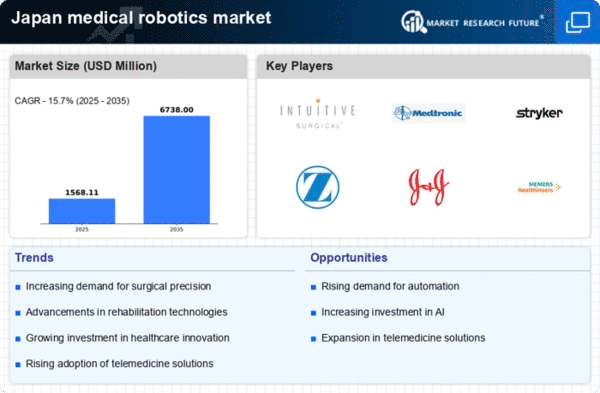

This market is experiencing a surge due to rapid technological advancements. Innovations in robotic systems, such as enhanced precision and minimally invasive techniques, are transforming surgical procedures. For instance, the introduction of robotic-assisted surgeries has shown to reduce recovery times by up to 30%. Furthermore, the integration of advanced imaging technologies with robotic systems is improving surgical outcomes. As a result, hospitals are increasingly investing in these technologies, leading to a projected growth rate of 15% annually in the medical robotics market. This trend indicates a strong commitment to adopting cutting-edge solutions that enhance patient care and operational efficiency.

Competitive Landscape and Market Dynamics

The competitive landscape is evolving rapidly, with numerous players vying for market share. Established companies are continuously innovating, while new entrants are introducing disruptive technologies. This dynamic environment is fostering a culture of innovation, leading to the development of advanced robotic systems that cater to diverse medical needs. Market analysis suggests that the competition could lead to a price reduction of up to 10% for robotic systems, making them more accessible to healthcare providers. As a result, the medical robotics market is likely to expand, driven by both technological advancements and competitive pricing strategies.

Rising Awareness and Acceptance of Robotics

There is a growing awareness and acceptance of robotic technologies among healthcare professionals and patients in Japan. Educational programs and workshops are being implemented to familiarize medical staff with the benefits of robotic systems, which are perceived to enhance surgical precision and patient safety. Surveys indicate that approximately 70% of surgeons express a favorable view towards integrating robotics into their practices. This shift in perception is expected to drive the medical robotics market forward, as more healthcare providers seek to incorporate these technologies into their operations. The increasing acceptance among patients also plays a crucial role in this trend, as they become more informed about the advantages of robotic-assisted procedures.