Expansion of Environmental Testing

Environmental testing is becoming increasingly critical in Japan, particularly in the context of pollution control and sustainability initiatives. The liquid chromatography-instruments market is poised to benefit from this trend, as these instruments are essential for analyzing contaminants in water, soil, and air samples. The Japanese government has implemented stricter environmental regulations, which necessitate accurate monitoring of pollutants. This regulatory environment is expected to drive the demand for liquid chromatography technologies, with the market projected to grow by approximately 5% annually. Furthermore, the increasing public awareness regarding environmental issues is likely to further stimulate investments in liquid chromatography-instruments, thereby enhancing their adoption across various sectors.

Growth in Food and Beverage Safety

The food and beverage industry in Japan is placing a heightened emphasis on safety and quality assurance, which is significantly impacting the liquid chromatography-instruments market. With the rise in foodborne illnesses and contamination cases, there is a pressing need for reliable analytical methods to ensure product safety. Liquid chromatography is widely recognized for its effectiveness in detecting pesticides, additives, and contaminants in food products. As a result, the market is expected to grow at a CAGR of around 7% over the next few years. The increasing consumer demand for organic and safe food products is likely to further drive the adoption of liquid chromatography technologies, reinforcing their importance in the food safety landscape.

Rising Demand in Pharmaceutical Sector

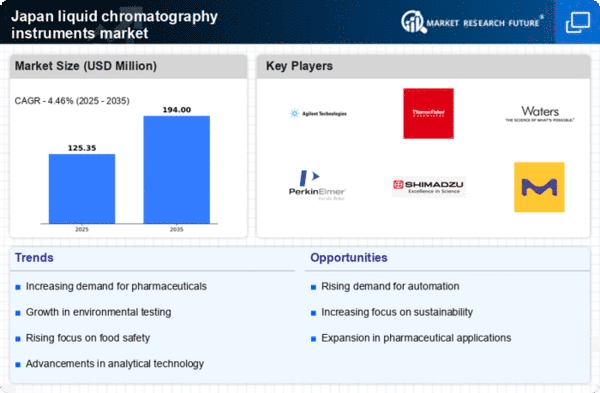

The pharmaceutical sector in Japan is experiencing a notable surge in demand for liquid chromatography-instruments. This growth is primarily driven by the increasing need for precise analytical techniques in drug development and quality control. As the industry expands, the liquid chromatography-instruments market is projected to witness a compound annual growth rate (CAGR) of approximately 6.5% over the next five years. The stringent regulations governing drug safety and efficacy further necessitate the use of advanced chromatographic techniques, thereby bolstering market growth. Additionally, the rise in biopharmaceuticals and personalized medicine is likely to create new opportunities for liquid chromatography applications, enhancing the overall landscape of the liquid chromatography-instruments market in Japan.

Technological Integration in Laboratories

The integration of advanced technologies in laboratory settings is transforming the operational landscape of the liquid chromatography-instruments market. Automation, data analytics, and artificial intelligence are increasingly being incorporated into chromatographic systems, enhancing efficiency and accuracy. This trend is particularly evident in Japan, where laboratories are striving to optimize workflows and reduce human error. The market is anticipated to experience a growth rate of approximately 6% as laboratories invest in modernizing their equipment. Furthermore, the demand for high-throughput screening methods is likely to propel the adoption of sophisticated liquid chromatography systems, thereby shaping the future of the liquid chromatography-instruments market.

Increased Investment in Research Institutions

Japan's commitment to scientific research and innovation is fostering a conducive environment for the liquid chromatography-instruments market. Increased funding for research institutions and universities is leading to enhanced capabilities in analytical chemistry. This investment is likely to drive the demand for liquid chromatography technologies, as researchers require advanced instruments for various applications, including drug discovery and environmental analysis. The market is projected to grow by approximately 5.5% as academic and research institutions expand their laboratories. Additionally, collaborations between industry and academia are expected to further stimulate advancements in liquid chromatography techniques, thereby enriching the overall landscape of the liquid chromatography-instruments market.