Aging Population and Healthcare Demand

Japan's demographic shift towards an aging population significantly impacts the interventional radiology-products market. With over 28% of the population aged 65 and older, there is a heightened demand for medical interventions that cater to age-related health issues. This demographic trend suggests that healthcare systems will increasingly rely on interventional radiology to provide effective treatments for conditions prevalent among older adults, such as vascular diseases and tumors. The interventional radiology-products market is poised for growth as healthcare providers adapt to the needs of this aging demographic, potentially leading to an increase in the adoption of minimally invasive procedures.

Investment in Healthcare Infrastructure

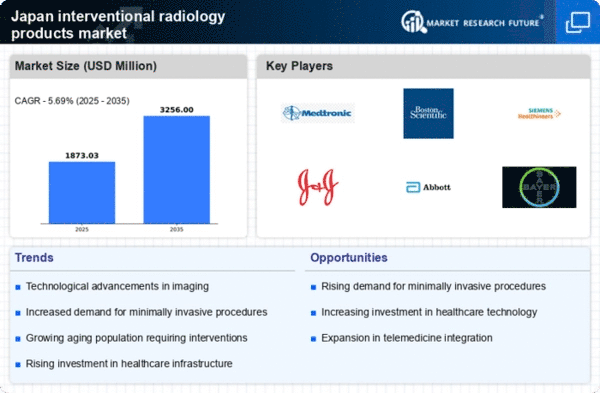

Japan's commitment to enhancing its healthcare infrastructure serves as a significant driver for the interventional radiology-products market. The government has allocated substantial funding to modernize healthcare facilities and integrate advanced medical technologies. Recent reports indicate that healthcare spending in Japan is projected to reach ¥50 trillion by 2025, with a portion dedicated to interventional radiology advancements. This investment is likely to facilitate the adoption of innovative products, thereby expanding the market. As hospitals and clinics upgrade their equipment and capabilities, the interventional radiology-products market is expected to experience robust growth, driven by improved access to cutting-edge technologies.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in Japan is a crucial driver for the interventional radiology-products market. Conditions such as cardiovascular diseases, cancer, and diabetes are becoming more prevalent, necessitating advanced treatment options. According to recent health statistics, approximately 30% of the Japanese population is affected by chronic illnesses, leading to a growing demand for interventional radiology solutions. This trend is likely to propel the market forward, as healthcare providers seek innovative products to enhance patient outcomes. The interventional radiology-products market is expected to benefit from this increasing patient population, as more healthcare facilities adopt these technologies to address the needs of chronic disease management.

Technological Integration in Medical Training

The integration of advanced technologies in medical training programs is emerging as a vital driver for the interventional radiology-products market. Educational institutions in Japan are increasingly incorporating simulation-based training and virtual reality tools to enhance the skills of medical professionals in interventional radiology. This focus on technological education is likely to improve the proficiency of practitioners, leading to higher adoption rates of interventional products. As healthcare providers become more adept at utilizing these technologies, the interventional radiology-products market may witness accelerated growth, driven by a well-trained workforce capable of delivering high-quality care.

Rising Awareness and Acceptance of Interventional Procedures

The growing awareness and acceptance of interventional procedures among both healthcare professionals and patients is a notable driver for the interventional radiology-products market. Educational initiatives and successful case studies have contributed to a better understanding of the benefits of these minimally invasive techniques. Surveys indicate that approximately 70% of patients are now more inclined to consider interventional options over traditional surgical methods. This shift in perception is likely to enhance the demand for interventional radiology products, as more patients seek out these alternatives for their treatment. Consequently, the interventional radiology-products market is expected to expand as acceptance continues to rise.