Growing Interest in Smart Cities

The concept of smart cities is gaining traction in Japan, with holographic communication playing a pivotal role in urban development. As cities strive to enhance connectivity and improve public services, holographic technology can facilitate better communication between citizens and local authorities. This technology can be utilized for urban planning, public safety, and community engagement initiatives. The market for smart city solutions is projected to reach $3 trillion by 2030, indicating a substantial opportunity for the holographic communication market to contribute to these developments. As municipalities invest in smart technologies, the demand for holographic communication solutions is likely to increase.

Government Initiatives and Support

The Japanese government is actively promoting the development of advanced communication technologies, including holographic communication. Various initiatives aim to foster innovation and support research in this field. For instance, funding programs and partnerships with private sectors are being established to accelerate the adoption of holographic solutions across industries. This governmental backing is crucial for the growth of the holographic communication market, as it encourages investment and development. With an estimated budget of ¥10 billion allocated for technology innovation in the upcoming fiscal year, the government’s commitment is likely to stimulate advancements in holographic communication.

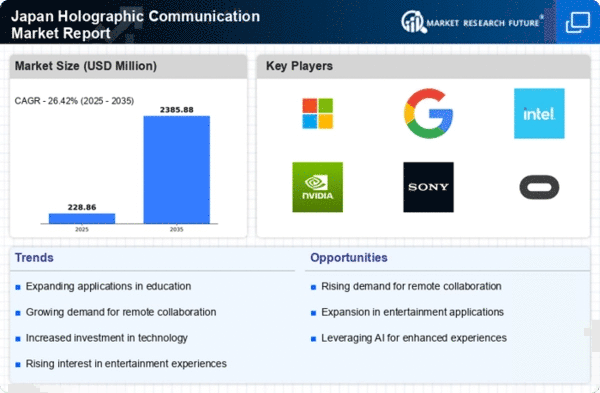

Rising Demand for Remote Collaboration

The increasing need for effective remote collaboration tools is driving the holographic communication market in Japan. As businesses seek innovative solutions to enhance communication among distributed teams, holographic technology offers a unique approach. This technology allows for real-time, three-dimensional interactions, which can significantly improve engagement and productivity. According to recent estimates, the market for remote collaboration tools is projected to grow at a CAGR of approximately 15% over the next five years. This trend indicates a strong potential for holographic communication solutions to capture a substantial share of the market, as organizations prioritize seamless collaboration in their operations.

Enhancement of Entertainment Experiences

The entertainment industry in Japan is increasingly adopting holographic communication technology to create immersive experiences for audiences. This trend is particularly evident in live performances, gaming, and virtual reality applications. Holographic displays can provide a more engaging and interactive experience, which is appealing to consumers. The market for holographic entertainment solutions is expected to reach $1 billion by 2027, reflecting a growing interest in innovative entertainment formats. As companies invest in holographic technology, the holographic communication market is likely to benefit from this expansion, offering new avenues for content delivery and audience engagement.

Integration with Artificial Intelligence

The integration of artificial intelligence (AI) with holographic communication technology is emerging as a key driver in Japan. AI enhances the capabilities of holographic systems, enabling more intuitive interactions and personalized experiences. For instance, AI algorithms can analyze user behavior and preferences, allowing holographic displays to adapt in real-time. This synergy between AI and holographic communication is expected to create new applications in various sectors, including marketing and customer service. As businesses increasingly recognize the potential of this integration, the holographic communication market is poised for growth, with projections indicating a potential increase in market size by 20% over the next few years.