Rising Disposable Incomes

Japan's economic landscape has seen a gradual increase in disposable incomes, which plays a crucial role in the expansion of the facial injectors market. As individuals experience improved financial stability, they are more inclined to invest in aesthetic treatments. The average disposable income in Japan has risen by approximately 3% annually, allowing consumers to allocate funds towards personal care and beauty enhancements. This trend is particularly evident in urban areas, where the demand for facial injectors is surging. The facial injectors market industry stands to gain significantly from this economic shift, as higher disposable incomes enable a larger segment of the population to access and afford these treatments, thereby driving market growth.

Influence of Aging Population

Japan's demographic profile, characterized by a rapidly aging population, serves as a significant driver for the facial injectors market. With a substantial portion of the population over the age of 65, there is an increasing demand for aesthetic solutions that address age-related concerns. This demographic is particularly interested in non-surgical options that offer minimal downtime and effective results. The facial injectors market industry is likely to see a surge in demand as older consumers seek to maintain a youthful appearance. Projections suggest that the market could expand by 10% in the coming years, driven by this aging demographic's desire for aesthetic enhancements that align with their lifestyle and self-image.

Expansion of Aesthetic Clinics

The proliferation of aesthetic clinics across Japan is a notable driver for the facial injectors market. As more clinics open, consumers gain greater access to a variety of injectable treatments. This expansion is often accompanied by increased marketing efforts, which raise awareness and educate potential clients about the benefits of facial injectors. The number of aesthetic clinics in Japan has increased by approximately 20% in the last five years, indicating a robust growth trend. This surge in clinic availability is likely to enhance the facial injectors market industry, as it provides consumers with more options and encourages them to explore injectable treatments as viable solutions for aesthetic enhancement.

Increasing Aesthetic Awareness

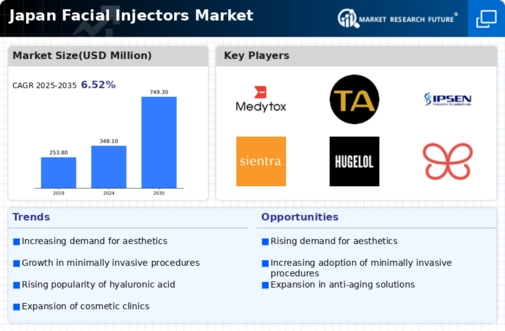

The growing awareness of aesthetic procedures among the Japanese population is a pivotal driver for the facial injectors market. As societal norms evolve, more individuals are seeking non-invasive solutions to enhance their appearance. This trend is particularly pronounced among younger demographics, who are increasingly influenced by social media and celebrity culture. Reports indicate that the aesthetic market in Japan is projected to grow at a CAGR of approximately 8% over the next five years. This heightened interest in personal aesthetics is likely to propel the demand for facial injectors, as consumers prioritize self-care and beauty enhancements. Consequently, the facial injectors market industry is expected to benefit from this cultural shift, leading to increased sales and a broader acceptance of injectable treatments across various age groups.

Growing Popularity of Preventative Treatments

The concept of preventative aesthetics is gaining traction in Japan, influencing the facial injectors market. Younger consumers are increasingly opting for treatments that prevent the onset of aging signs rather than waiting for them to appear. This proactive approach to beauty is reshaping consumer behavior, with many individuals seeking injectables as a means to maintain their youthful appearance. The facial injectors market industry is poised to benefit from this trend, as it aligns with the desires of a health-conscious population that values early intervention. Market analysts suggest that this shift could lead to a 15% increase in demand for facial injectors over the next few years, as more consumers embrace preventative measures in their beauty regimens.