Expansion of Charging Infrastructure

The expansion of charging infrastructure is a critical driver for the Japan Electric Motorcycles Market. The Japanese government and private sector are investing in the development of a comprehensive network of charging stations to support electric vehicle adoption. By 2026, it is anticipated that the number of charging stations will increase significantly, making it more convenient for electric motorcycle users to charge their vehicles. This enhanced accessibility is likely to alleviate range anxiety among potential consumers, encouraging more individuals to consider electric motorcycles as a viable transportation option. Consequently, the growth of charging infrastructure is expected to play a pivotal role in the expansion of the Japan Electric Motorcycles Market.

Consumer Demand for Sustainable Transportation

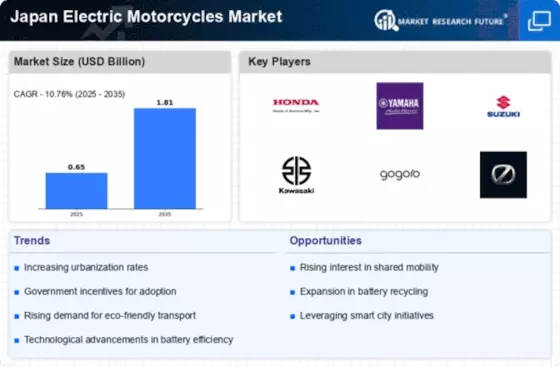

The Japan Electric Motorcycles Market is experiencing a surge in consumer demand for sustainable transportation solutions. As awareness of environmental issues grows, more consumers are seeking eco-friendly alternatives to traditional gasoline-powered motorcycles. This shift in consumer preferences is reflected in market data, which indicates a steady increase in electric motorcycle sales over the past few years. In 2025, electric motorcycles are projected to account for a significant share of the overall motorcycle market in Japan. This growing demand is prompting manufacturers to expand their electric motorcycle offerings, thereby driving innovation and competition within the Japan Electric Motorcycles Market.

Increasing Urbanization and Traffic Congestion

Urbanization trends in Japan are contributing to the growth of the Japan Electric Motorcycles Market. As cities become more densely populated, traffic congestion is becoming a pressing issue. Electric motorcycles offer a practical solution for urban commuting, providing a nimble and efficient mode of transportation. In major cities like Tokyo and Osaka, the demand for electric motorcycles is rising as they allow riders to navigate through traffic more easily. This shift towards electric motorcycles is further supported by the need for sustainable transportation options in urban areas, indicating a potential growth trajectory for the Japan Electric Motorcycles Market.

Technological Innovations in Electric Motorcycles

Technological advancements play a crucial role in shaping the Japan Electric Motorcycles Market. Innovations in battery technology, such as solid-state batteries, are enhancing the performance and range of electric motorcycles. For instance, the introduction of fast-charging capabilities is expected to reduce charging times significantly, making electric motorcycles more appealing to consumers. Additionally, improvements in lightweight materials and electric drivetrains are contributing to better efficiency and performance. As these technologies continue to evolve, they are likely to attract a broader customer base, thereby stimulating growth in the Japan Electric Motorcycles Market.

Government Regulations Promoting Electric Vehicles

The Japan Electric Motorcycles Market is significantly influenced by government regulations aimed at promoting electric vehicles. The Japanese government has set ambitious targets to reduce greenhouse gas emissions, with a goal of achieving carbon neutrality by 2050. This regulatory framework includes incentives for electric motorcycle manufacturers and consumers, such as subsidies and tax breaks. In 2025, the government plans to implement stricter emissions standards, which could further accelerate the shift towards electric motorcycles. As a result, manufacturers are increasingly investing in electric motorcycle technology to comply with these regulations, thereby driving growth in the Japan Electric Motorcycles Market.