Emergence of Smart City Initiatives

The emergence of smart city initiatives in Japan is significantly influencing the diameter signaling market. As urban areas evolve into smart cities, the demand for interconnected systems and efficient communication networks intensifies. Diameter signaling plays a crucial role in managing the data flow between various smart city applications, such as traffic management, public safety, and energy efficiency. The Japanese government has committed to investing approximately $50 billion in smart city projects by 2025, which is likely to create substantial opportunities for diameter signaling solutions. This trend indicates a growing recognition of the importance of advanced signaling technologies in supporting the infrastructure of smart cities, thereby driving the diameter signaling market.

Expansion of Mobile Payment Solutions

The diameter signaling market is witnessing a transformative shift due to the expansion of mobile payment solutions in Japan. As digital payment methods gain traction, telecommunications operators are increasingly integrating diameter signaling protocols to facilitate secure and efficient transactions. The mobile payment market in Japan is projected to exceed $100 billion by 2025, creating a substantial opportunity for diameter signaling solutions. This integration allows for real-time transaction processing and enhances user experience, which is crucial in a competitive landscape. As more consumers adopt mobile payment options, the demand for reliable signaling infrastructure will likely escalate, further propelling the growth of the diameter signaling market.

Growing Focus on Security and Fraud Prevention

In the context of the diameter signaling market, security concerns are becoming increasingly critical for telecommunications providers in Japan. With the rise in cyber threats and fraud attempts, operators are prioritizing the implementation of robust signaling security measures. The market for diameter signaling solutions that incorporate advanced security features is expected to grow significantly, as operators seek to protect sensitive user data and maintain service integrity. Reports indicate that fraud losses in the telecommunications sector could reach $30 billion annually by 2025, underscoring the urgency for effective signaling solutions. This focus on security not only safeguards operators but also enhances consumer trust, thereby driving further investment in the diameter signaling market.

Increased Investment in Network Infrastructure

Investment in network infrastructure is a pivotal driver for the diameter signaling market in Japan. Telecommunications companies are allocating substantial resources to upgrade their existing networks to support the growing demand for data services. With the advent of 5G technology, operators are compelled to enhance their signaling capabilities to manage increased data traffic effectively. Reports suggest that Japan's telecom sector is expected to invest over $20 billion in network infrastructure by 2025. This investment not only facilitates the deployment of advanced technologies but also strengthens the overall signaling framework, thereby fostering growth in the diameter signaling market. Enhanced infrastructure is essential for ensuring seamless connectivity and service reliability.

Rising Demand for Enhanced Network Performance

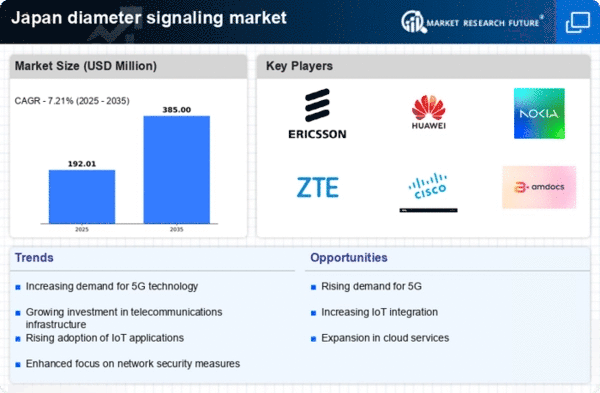

The diameter signaling market in Japan is experiencing a notable surge in demand for enhanced network performance. As telecommunications companies strive to provide superior services, the need for efficient signaling protocols becomes paramount. This demand is driven by the increasing number of mobile subscribers, which reached approximately 180 million in 2025. Consequently, operators are investing heavily in diameter signaling solutions to manage network traffic effectively. The market is projected to grow at a CAGR of around 15% from 2025 to 2030, indicating a robust expansion. Enhanced network performance not only improves user experience but also supports the deployment of advanced applications such as IoT and smart city initiatives, further propelling the diameter signaling market in Japan.