Emphasis on Enhanced Security Measures

In the context of the cognitive services-platform market, the emphasis on enhanced security measures is becoming increasingly critical in Japan. As organizations adopt cognitive technologies, concerns regarding data privacy and cybersecurity are paramount. Recent reports indicate that cyber threats have escalated, prompting businesses to invest in robust security frameworks. This trend is reflected in the allocation of approximately 30% of IT budgets towards security solutions. Consequently, cognitive services that incorporate advanced security features are in high demand, as organizations seek to protect sensitive information while leveraging cognitive capabilities. This focus on security is likely to shape the development and adoption of cognitive services in the market.

Rising Demand for Automation Solutions

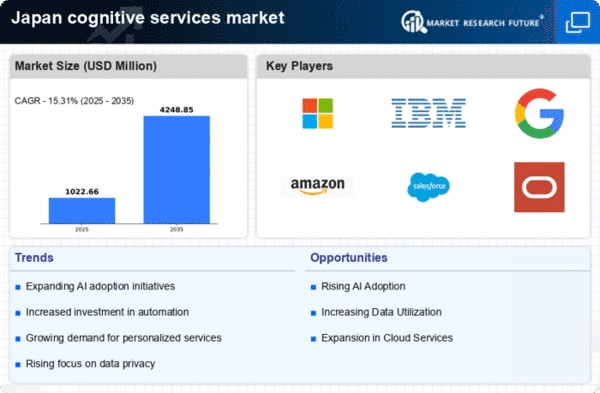

The cognitive services market in Japan is experiencing a notable surge in demand for automation solutions across various sectors. Industries such as manufacturing, finance, and healthcare are increasingly adopting cognitive technologies to streamline operations and enhance productivity. According to recent data, the automation market in Japan is projected to grow at a CAGR of approximately 15% over the next five years. This trend indicates a strong inclination towards integrating cognitive services to reduce manual intervention and improve efficiency. As organizations seek to optimize their processes, the cognitive services-platform market is likely to benefit significantly from this shift towards automation, positioning itself as a critical enabler of operational excellence.

Expansion of Cloud Computing Infrastructure

The expansion of cloud computing infrastructure in Japan is a pivotal factor driving the cognitive services-platform market. With the increasing adoption of cloud technologies, businesses are gaining access to scalable and flexible cognitive services that can be deployed rapidly. Recent statistics suggest that the cloud services market in Japan is expected to reach $20 billion by 2026, indicating a strong trend towards cloud-based solutions. This shift allows organizations to leverage cognitive services without the burden of extensive on-premises infrastructure. As cloud adoption continues to rise, the cognitive services-platform market is likely to flourish, providing businesses with innovative tools to enhance their operations.

Increased Focus on Data-Driven Decision Making

In Japan, there is a marked shift towards data-driven decision making, which is significantly influencing the cognitive services-platform market. Organizations are increasingly recognizing the value of leveraging data analytics and cognitive insights to inform strategic choices. This trend is reflected in a survey indicating that over 70% of Japanese companies prioritize data analytics in their operational strategies. Consequently, the demand for cognitive services that facilitate data interpretation and actionable insights is on the rise. As businesses strive to enhance their competitive edge, the cognitive services-platform market is likely to see robust growth, driven by the need for sophisticated analytical tools and platforms.

Growing Investment in AI Research and Development

Investment in artificial intelligence (AI) research and development is a key driver for the cognitive services market in Japan. The government and private sector are channeling substantial resources into AI initiatives, with funding reaching approximately $1 billion in recent years. This financial commitment is aimed at fostering innovation and enhancing the capabilities of cognitive services. As a result, the cognitive services-platform market is poised to expand, driven by advancements in machine learning, natural language processing, and computer vision. The emphasis on R&D not only supports the development of cutting-edge technologies but also encourages collaboration between academia and industry, further propelling market growth.