Regulatory Compliance Pressures

In Japan, regulatory compliance plays a crucial role in shaping the cloud backup market. With stringent data protection laws, such as the Act on the Protection of Personal Information (APPI), businesses are compelled to implement effective backup strategies. As of 2025, around 60% of companies report that compliance with these regulations influences their choice of cloud backup solutions. The cloud backup market must adapt to these evolving legal frameworks, ensuring that their offerings align with compliance requirements. This necessity not only drives demand for cloud backup services but also encourages innovation in data management practices, as organizations strive to meet legal obligations.

Growing Cloud Adoption Among SMEs

Small and medium-sized enterprises (SMEs) in Japan are increasingly recognizing the benefits of cloud technology, which is driving growth in the cloud backup market. As of 2025, it is estimated that around 40% of SMEs have adopted cloud-based solutions for their operations. This trend is largely attributed to the cost-effectiveness and scalability of cloud services, making them an attractive option for smaller businesses. The cloud backup market stands to gain from this shift, as SMEs seek affordable and efficient backup solutions to protect their data. This growing segment presents a significant opportunity for cloud backup providers to tailor their offerings to meet the specific needs of SMEs.

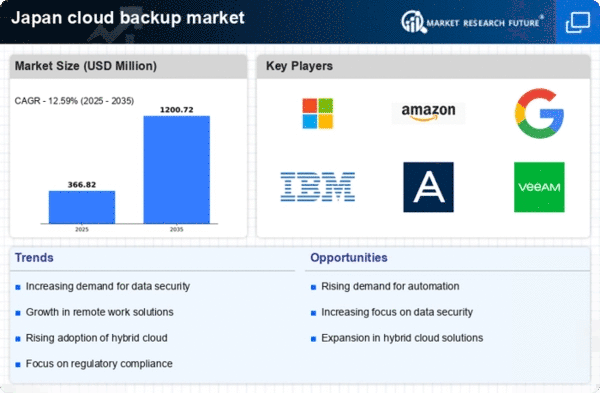

Rising Demand for Data Protection

The cloud backup market in Japan experiences a notable surge in demand for data protection solutions. As businesses increasingly rely on digital infrastructure, the necessity to safeguard sensitive information becomes paramount. In 2025, it is estimated that approximately 70% of organizations in Japan prioritize data security, driving investments in cloud backup services. This trend is further fueled by the growing awareness of data breaches and cyber threats, compelling companies to adopt robust backup solutions. The cloud backup market is thus positioned to benefit from this heightened focus on data integrity and security, as organizations seek reliable methods to protect their critical assets.

Shift Towards Remote Work Environments

The transition to remote work has significantly impacted the cloud backup market in Japan. As organizations embrace flexible work arrangements, the need for secure and accessible data storage solutions has intensified. In 2025, it is projected that over 50% of the workforce in Japan will engage in remote work, necessitating reliable cloud backup services. This shift prompts businesses to invest in solutions that facilitate seamless access to data while ensuring its protection. Consequently, the cloud backup market is likely to witness increased adoption of services that cater to the unique challenges posed by remote work, such as data accessibility and security.

Technological Advancements in Backup Solutions

Technological innovations are reshaping the landscape of the cloud backup market in Japan. The integration of artificial intelligence (AI) and machine learning (ML) into backup solutions enhances data management and recovery processes. In 2025, it is anticipated that approximately 30% of cloud backup services will incorporate AI-driven features, improving efficiency and reliability. This trend indicates a shift towards more intelligent backup systems that can predict potential failures and automate recovery processes. The cloud backup market is thus poised for transformation, as advancements in technology not only streamline operations but also provide businesses with enhanced capabilities to safeguard their data.