Rising Birth Rates

The increasing birth rates in Japan have a direct impact on the breast pumps market. As more families choose to have children, the demand for breastfeeding products, including breast pumps, is likely to rise. Recent statistics indicate that the birth rate in Japan has shown a slight increase, which may lead to a higher number of breastfeeding mothers seeking efficient solutions for milk expression. This trend suggests a growing market potential for breast pumps, as new mothers often prioritize convenience and effectiveness in their breastfeeding journey. The breast pumps market is poised to benefit from this demographic shift, as manufacturers may introduce innovative products tailored to the needs of new mothers.

Technological Innovations

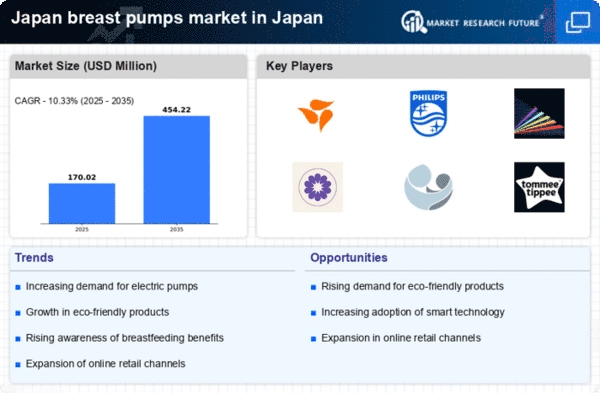

Technological innovations in the breast pumps market are transforming the way mothers express milk. Advances in design, efficiency, and user-friendliness are making breast pumps more appealing to consumers. Features such as smart technology, portability, and quieter operation are becoming increasingly important to modern mothers. The breast pumps market is witnessing a surge in demand for electric and hands-free models, which offer convenience and flexibility. As manufacturers continue to invest in research and development, the introduction of new technologies may further enhance the appeal of breast pumps, potentially leading to increased sales and market growth.

Increased Health Awareness

Increased health awareness among Japanese consumers is contributing to the growth of the breast pumps market. As more individuals recognize the health benefits of breastfeeding for both mothers and infants, the demand for breast pumps is likely to rise. Educational campaigns and resources promoting breastfeeding are becoming more prevalent, which may lead to a greater acceptance of breast pumps as essential tools for nursing mothers. The breast pumps market stands to gain from this heightened awareness, as it encourages mothers to invest in quality products that support their breastfeeding goals. This trend suggests a positive outlook for the market as health-conscious consumers seek effective solutions.

Changing Consumer Preferences

Changing consumer preferences are shaping the breast pumps market in Japan. As more mothers prioritize convenience and flexibility, there is a noticeable shift towards electric and portable breast pumps. This trend indicates that consumers are seeking products that fit seamlessly into their busy lifestyles. The breast pumps market is adapting to these preferences by offering a wider range of options that cater to the needs of modern mothers. Additionally, the rise of online shopping has made it easier for consumers to access various breast pump models, further driving market growth. Understanding these evolving preferences is crucial for manufacturers aiming to capture a larger share of the market.

Government Initiatives and Support

Government initiatives aimed at promoting breastfeeding are likely to bolster the breast pumps market in Japan. Various programs and campaigns encourage mothers to breastfeed, which in turn increases the demand for breast pumps. The Japanese government has implemented policies that support maternal health and breastfeeding practices, potentially leading to a rise in the number of mothers utilizing breast pumps. This supportive environment may enhance the breast pumps market, as it encourages manufacturers to develop products that align with government guidelines and consumer needs. The collaboration between public health initiatives and the breast pumps market could result in increased awareness and accessibility of breastfeeding solutions.