Diverse Flavor Offerings

The bottled water market in Japan is diversifying its product offerings to include flavored and enhanced waters, catering to a wider range of consumer preferences. This trend reflects a growing interest in unique taste experiences among Japanese consumers, who are increasingly willing to explore new flavors. Data shows that flavored bottled water has seen a growth rate of approximately 15% in recent years, indicating a strong market potential. By expanding their product lines to include various flavors and functional ingredients, companies in the bottled water market can attract new customers and retain existing ones, thereby enhancing their competitive edge.

Rising Health Consciousness

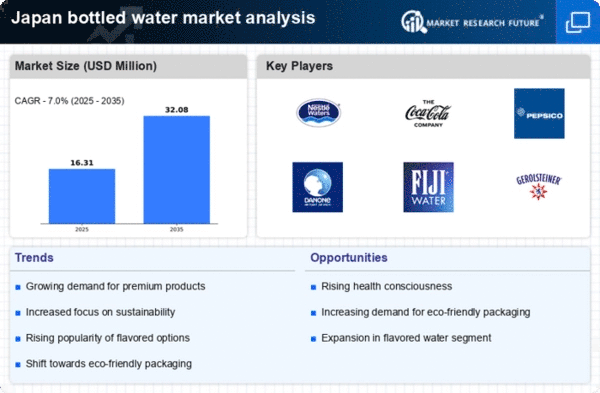

The increasing awareness of health and wellness among consumers in Japan appears to be a primary driver for the bottled water market. As individuals prioritize hydration and seek healthier beverage options, the demand for bottled water has surged. Recent data indicates that the bottled water market in Japan has experienced a growth rate of approximately 8% annually. This trend is likely to continue as consumers become more discerning about their beverage choices, favoring products that promote health benefits. The bottled water market is thus positioned to capitalize on this shift, offering a variety of options that cater to health-conscious consumers, including mineral-rich and functional waters.

Innovative Packaging Solutions

The bottled water market in Japan is witnessing a shift towards innovative packaging solutions that appeal to environmentally conscious consumers. Companies are increasingly adopting eco-friendly materials and designs, which not only enhance the product's appeal but also address sustainability concerns. Recent statistics indicate that around 30% of consumers prefer brands that utilize recyclable or biodegradable packaging. This trend suggests that the bottled water market is evolving to meet consumer expectations for sustainability, potentially leading to increased market share for brands that prioritize eco-friendly practices. As the industry adapts to these preferences, it may also attract a broader customer base.

Convenience and On-the-Go Consumption

The fast-paced lifestyle of urban dwellers in Japan has led to a significant increase in the demand for convenient beverage options. Bottled water, being portable and easy to consume, aligns perfectly with the needs of busy consumers. The bottled water market benefits from this trend, as sales in convenience stores and vending machines have risen sharply. Data suggests that over 60% of bottled water sales occur through these channels, highlighting the importance of accessibility. As more consumers seek hydration solutions that fit their on-the-go lifestyles, the bottled water market is likely to see sustained growth, driven by the need for convenience.

Increased Focus on Hydration Education

The bottled water market in Japan is benefiting from a heightened focus on hydration education among consumers. As health organizations and brands promote the importance of adequate water intake, awareness of the benefits of hydration is growing. This educational push appears to be influencing consumer behavior, leading to increased bottled water consumption. Recent surveys indicate that nearly 70% of consumers recognize the importance of staying hydrated, which bodes well for the bottled water market. As educational initiatives continue to evolve, they may further drive demand, positioning the bottled water market for sustained growth in the coming years.