Increasing Water Scarcity

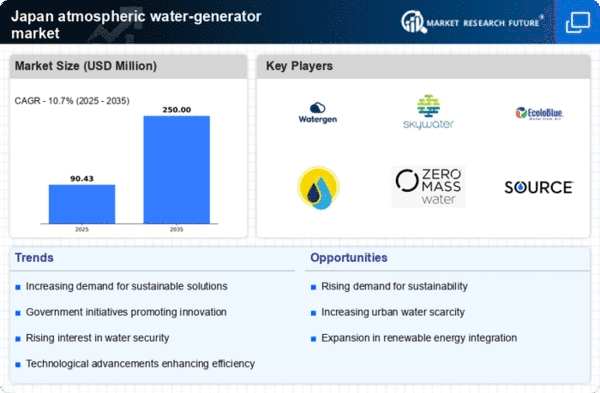

Japan faces increasing challenges related to water scarcity, particularly in urban areas where demand for fresh water is high. The atmospheric water-generator market appears poised to address this issue by providing an alternative source of potable water. As climate change continues to impact precipitation patterns, the reliance on traditional water sources may diminish. The market could potentially see a surge in demand as municipalities and businesses seek innovative solutions to ensure water availability. Reports indicate that the market for atmospheric water generators in Japan is expected to grow at a CAGR of approximately 15% over the next five years, driven by the urgent need for sustainable water solutions.

Technological Innovations

Technological advancements in atmospheric water generation technology are likely to play a crucial role in the market's expansion. Innovations such as improved condensation techniques and energy-efficient systems are enhancing the efficiency and affordability of these devices. The atmospheric water-generator market in Japan may experience increased adoption as these technologies become more accessible to consumers and businesses alike. For instance, recent developments have led to units that can produce water at lower humidity levels, making them suitable for a wider range of environments. This could potentially broaden the market's appeal and increase its penetration in both residential and commercial sectors.

Rising Environmental Awareness

There is a notable increase in environmental awareness among the Japanese population, which influences consumer preferences and purchasing decisions. The atmospheric water-generator market benefits from this trend as individuals and organizations seek eco-friendly alternatives to bottled water. The market appears to be gaining traction as consumers become more conscious of plastic waste and its environmental impact. This shift in mindset may lead to a greater acceptance of atmospheric water generators as a viable solution. Furthermore, the government has been promoting initiatives aimed at reducing plastic usage, which could further bolster the market's growth as consumers look for sustainable options.

Government Support and Incentives

The Japanese government appears to be increasingly supportive of initiatives that promote sustainable water solutions. Various programs and incentives aimed at encouraging the adoption of atmospheric water generators are being introduced. This supportive regulatory environment may facilitate market growth by reducing barriers to entry for manufacturers and consumers. Additionally, public awareness campaigns about water conservation and sustainability could further stimulate interest in the atmospheric water-generator market. As the government continues to prioritize environmental sustainability, the market may benefit from favorable policies and funding opportunities that encourage innovation and investment.

Urbanization and Population Growth

Japan's ongoing urbanization and population growth are likely to drive demand for innovative water solutions. As cities expand and populations increase, the pressure on existing water resources intensifies. The atmospheric water-generator market may find a receptive audience in densely populated urban areas where traditional water supply systems are strained. The convenience and efficiency of atmospheric water generators could appeal to urban residents and businesses seeking reliable water sources. Market analysts suggest that the urban population's increasing reliance on technology for daily needs may further enhance the attractiveness of these devices, potentially leading to a significant uptick in market penetration.