Rising Geriatric Population

The growing geriatric population in Japan significantly drives the articaine hydrochloride market. As the elderly demographic grows, there is a corresponding rise in dental issues that require effective pain management during treatment. Articaine is particularly beneficial for older patients, as it provides effective anesthesia with a lower risk of systemic side effects. Current estimates indicate that by 2025, approximately 30% of Japan's population will be aged 65 and older, which could lead to a surge in demand for dental services and, consequently, for articaine hydrochloride. This demographic shift suggests a promising outlook for the market.

Increasing Dental Procedures

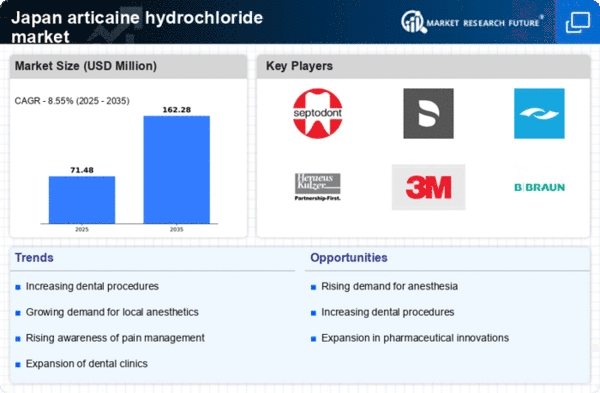

The articaine hydrochloride market in Japan is experiencing growth due to the rising number of dental procedures performed annually. As dental health awareness increases, more individuals seek preventive and corrective treatments, leading to a higher demand for effective anesthetics. Articaine, known for its rapid onset and effectiveness, is becoming a preferred choice among dental practitioners. In 2023, the number of dental procedures in Japan was estimated to exceed 30 million, with projections indicating a steady increase. This trend suggests that the articaine hydrochloride market will continue to expand as dental practices adopt this anesthetic to enhance patient comfort and satisfaction.

Growing Aesthetic Dentistry Sector

The aesthetic dentistry sector in Japan is expanding, contributing positively to the articaine hydrochloride market. As more individuals prioritize cosmetic dental procedures, the need for effective anesthetics during treatments such as teeth whitening, veneers, and implants increases. Articaine's properties make it particularly suitable for these procedures, as it provides effective pain management with minimal side effects. Market data suggests that the aesthetic dentistry segment is projected to grow by 7% annually, further driving the demand for articaine hydrochloride. This growth reflects a broader trend towards enhancing dental aesthetics, which is likely to sustain the articaine hydrochloride market's expansion.

Technological Advancements in Dentistry

Technological innovations in dental practices are significantly impacting the articaine hydrochloride market. The introduction of advanced dental equipment and techniques, such as digital imaging and minimally invasive procedures, has increased the efficiency and effectiveness of dental treatments. These advancements often require the use of high-quality anesthetics like articaine to ensure patient comfort during procedures. As dental technology continues to evolve, the demand for articaine hydrochloride is likely to rise, with market analysts estimating a growth rate of approximately 5% annually in the coming years. This trend indicates a robust future for the articaine hydrochloride market in Japan.

Regulatory Framework and Quality Assurance

The regulatory framework governing dental practices in Japan plays a crucial role in shaping the articaine hydrochloride market. Stringent safety and quality standards ensure that only the most effective anesthetics are used in dental procedures. Regulatory bodies continuously monitor the market to ensure compliance with safety protocols, which enhances consumer confidence in products like articaine. This regulatory support is vital for maintaining high standards in dental care, and it is expected to bolster the articaine hydrochloride market as practitioners seek reliable anesthetic options. The emphasis on quality assurance may lead to a market growth rate of around 4% in the coming years.