Growth of Mobile-First Businesses

The emergence of mobile-first businesses significantly influences the 4g lte market in Japan. Companies that prioritize mobile platforms for their operations are increasingly reliant on robust mobile connectivity to deliver services and engage customers effectively. This shift is evident in sectors such as e-commerce, where businesses leverage mobile applications to enhance user experience and streamline transactions. As of 2025, it is estimated that mobile commerce will account for over 50% of total e-commerce sales in Japan, underscoring the critical role of mobile connectivity. Consequently, the demand for reliable 4g lte services is expected to rise, prompting telecommunications providers to enhance their offerings to cater to this growing segment.

Increased Adoption of Smart Devices

The proliferation of smart devices in Japan is a key driver of the 4g lte market. With the increasing penetration of smartphones, tablets, and wearables, consumers are demanding seamless connectivity to support their digital lifestyles. As of November 2025, it is estimated that over 80% of the population owns a smartphone, leading to a corresponding rise in mobile data usage. This trend is further amplified by the integration of smart devices into everyday life, such as smart home technologies and health monitoring applications. As users seek to connect multiple devices simultaneously, the demand for robust 4g lte services is likely to escalate, prompting network operators to invest in expanding their infrastructure to accommodate this growing need.

Rising Demand for High-Speed Connectivity

The 4g lte market in Japan experiences a notable surge in demand for high-speed connectivity, driven by the increasing reliance on mobile internet for various applications. As consumers and businesses alike seek faster data transfer rates, the market is projected to grow significantly. According to recent data, mobile data traffic in Japan is expected to increase by approximately 30% annually, indicating a robust appetite for enhanced connectivity solutions. This trend is further fueled by the proliferation of streaming services, online gaming, and remote work, all of which require reliable and swift internet access. Consequently, telecommunications providers are compelled to invest in infrastructure upgrades to meet this escalating demand, thereby propelling the growth of the 4g lte market.

Competitive Landscape Among Service Providers

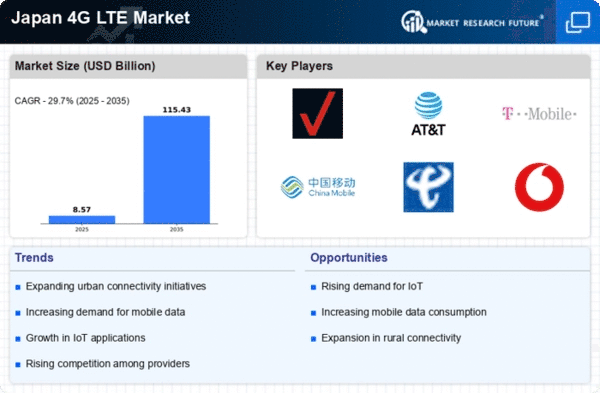

The competitive landscape among service providers significantly impacts the 4g lte market in Japan. With multiple operators vying for market share, there is a continuous push for innovation and improved service offerings. This competition often leads to attractive pricing strategies, promotional packages, and enhanced customer service, benefiting consumers. As of November 2025, the market is characterized by a diverse range of plans and services tailored to meet varying consumer needs. Additionally, operators are increasingly focusing on customer retention strategies, such as loyalty programs and value-added services, to differentiate themselves in a crowded marketplace. This competitive dynamic is likely to drive further investments in network enhancements, ultimately benefiting the overall growth of the 4g lte market.

Technological Advancements in Network Infrastructure

Technological advancements play a pivotal role in shaping the 4g lte market in Japan. The ongoing evolution of network infrastructure, including the deployment of advanced antennas and improved signal processing technologies, enhances the overall performance of 4g lte networks. These innovations not only increase data speeds but also improve network reliability and coverage. For instance, the introduction of Massive MIMO technology has been shown to boost capacity and efficiency, allowing operators to serve more users simultaneously. As a result, the market is likely to witness a significant uptick in user satisfaction and retention, further driving the adoption of 4g lte services across various demographics.