Increased Focus on Data Security

Data security remains a paramount concern for organizations in Italy, significantly influencing the software defined-data-center market. With the rise in cyber threats, businesses are prioritizing robust security measures to protect sensitive information. The software defined-data-center architecture offers enhanced security features, such as micro-segmentation and automated compliance checks, which are increasingly being adopted by Italian firms. Reports indicate that approximately 70% of organizations in Italy are investing in advanced security solutions within their data centers. This heightened focus on security not only mitigates risks but also fosters trust among clients and stakeholders, thereby propelling the growth of the software defined-data-center market.

Shift Towards Hybrid IT Environments

The transition to hybrid IT environments is reshaping the software defined-data-center market in Italy. Organizations are increasingly adopting a combination of on-premises and cloud-based solutions to achieve greater flexibility and scalability. This hybrid approach allows businesses to optimize their workloads and manage costs effectively. Current estimates suggest that around 55% of Italian enterprises are implementing hybrid IT strategies, reflecting a growing preference for adaptable infrastructure. As companies seek to balance performance and cost-efficiency, the software defined-data-center market is likely to benefit from this trend, as it provides the necessary tools and frameworks to support hybrid deployments.

Emergence of Edge Computing Solutions

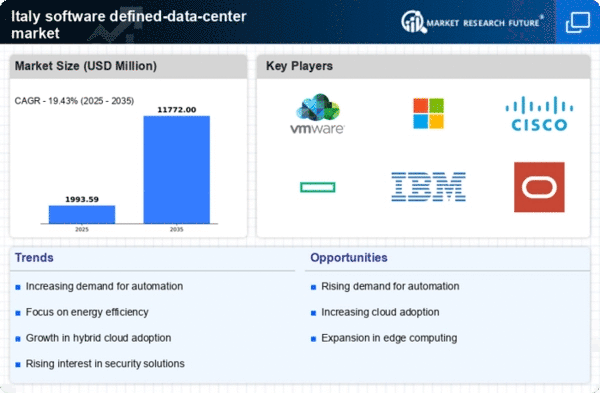

The rise of edge computing is emerging as a transformative force within the software defined-data-center market in Italy. As organizations increasingly require real-time data processing and low-latency applications, edge computing solutions are gaining traction. This trend is particularly relevant for industries such as manufacturing and healthcare, where immediate data analysis is critical. By 2025, it is projected that investments in edge computing technologies will contribute significantly to the software defined-data-center market, with Italian companies recognizing the need for localized data processing capabilities. This shift not only enhances operational efficiency but also aligns with the broader trend of digital transformation across various sectors.

Rising Demand for Virtualization Solutions

The software defined-data-center market in Italy experiences a notable surge in demand for virtualization solutions. As organizations increasingly seek to optimize their IT infrastructure, virtualization technologies enable efficient resource allocation and management. This trend is reflected in the growing number of enterprises adopting virtualization, with estimates suggesting that over 60% of Italian companies have implemented some form of virtualization by 2025. This shift not only enhances operational efficiency but also reduces hardware costs, thereby driving the software defined-data-center market forward. Furthermore, the ability to quickly scale resources in response to fluctuating business needs positions virtualization as a critical component in the evolving landscape of IT management.

Government Initiatives Supporting Digital Transformation

The Italian government actively promotes digital transformation initiatives, which significantly impact the software defined-data-center market. Policies aimed at enhancing digital infrastructure and encouraging innovation are driving investments in advanced technologies. For instance, the Italian National Recovery and Resilience Plan allocates substantial funding for digitalization projects, with an emphasis on cloud computing and data center modernization. This governmental support is expected to catalyze growth in the software defined-data-center market, as businesses leverage these initiatives to upgrade their IT capabilities. By 2025, it is anticipated that public sector investments will account for a considerable share of the overall market growth, fostering a conducive environment for technological advancements.